Gusto Review: Pricing, Features, and IT Admin Perspective

Honest Gusto review from an IT admin perspective. Auto-pilot payroll, Google Workspace sync, pricing breakdown, and when to skip it.

Affiliate Disclosure: This article contains affiliate links. If you make a purchase through these links, we may earn a small commission at no extra cost to you.

Manual payroll increases the risk of compliance errors, which can lead to compounding IRS penalties and administrative overhead. Gusto automates payroll processing, tax filing, and compliance for over 400,000 businesses, reducing these risks through automated tax calculations and filing.

This review evaluates Gusto from an IT admin's perspective: how it integrates with your tech stack, handles employee onboarding automation, and manages security workflows during offboarding.

Bottom line: Gusto is the best automated payroll solution for U.S.-based teams under 50 employees. It excels at tax compliance and Google Workspace/Microsoft 365 integration. Skip it if you need construction-specific job costing or require dedicated account management.

Gusto at a Glance

| Feature | Details |

|---|---|

| Starting Price | $49/mo + $6/employee (Simple plan) |

| Best Plan | Plus ($80/mo + $12/employee) - includes multi-state, time tracking |

| Tax Filing | Automatic federal, state, local - all included |

| Time Tracking | Yes - includes project-based workforce costing (Plus/Premium) |

| Integrations | Google Workspace, Microsoft 365, QuickBooks, Xero, 180+ apps |

| Phone Support | All plans (Premium gets priority + dedicated CSM) |

| Best For | 5-50 employees, remote teams, service businesses |

| Skip If | Construction job costing, international-first, need dedicated CSM |

How Much Does Gusto Cost?

Gusto pricing starts at $49 per month plus $6 per employee for the Simple plan. Most growing businesses choose the Plus plan ($80/mo + $12/person) to unlock multi-state payroll and time tracking features.

The Simple plan base fee increased from $40 to $49 in March 2025. Add-ons like international payroll and benefits administration cost extra.

Core Plans

| Plan | Base Fee | Per Employee | Best For |

|---|---|---|---|

| Simple | $49/mo | $6/mo | Single-state, basic payroll only |

| Plus | $80/mo | $12/mo | Multi-state, time tracking, next-day pay |

| Premium | $180/mo | $22/mo | Dedicated support, HR experts, custom reports |

| Contractor Only | $35/mo | $6/contractor | 1099 contractors only (no W-2 employees) |

Pricing note: The Simple plan increased from $40 to $49/mo in March 2025. For a 10-person team, that's an extra $108/year before any add-ons.

What's Included vs. What Costs Extra

All plans include:

- Unlimited payroll runs

- Automatic federal, state, and local tax filing

- Employee self-service portal

- Direct deposit

- W-2 and 1099 generation

- State tax registration support (all 50 states - one-time registration fees may apply per state)

Add-ons that cost extra:

- Performance reviews and compensation management

- Gusto Global (international contractors/EOR): $599/mo per employee through 2026 (normally $699)

- Multi-state tax registration fees (one-time setup per state)

- Benefits administration (health insurance premiums billed separately)

Real-World Cost Examples

5-person startup (Simple plan):

- Base: $49/mo

- Employees: 5 × $6 = $30/mo

- Total: $79/mo ($948/year)

15-person agency (Plus plan):

- Base: $80/mo

- Employees: 15 × $12 = $180/mo

- Total: $260/mo ($3,120/year)

25-person company (Premium plan):

- Base: $180/mo

- Employees: 25 × $22 = $550/mo

- Total: $730/mo ($8,760/year)

The Plus Plan Sweet Spot

For most small businesses, the Plus plan ($80/mo base) is the best value. You get multi-state payroll, built-in time tracking, and next-day direct deposit—features that would cost extra with competitors. The Simple plan's single-state limitation is too restrictive if you have any remote employees.

How Gusto Compares to Traditional Payroll Costs

Hiring an accountant to run payroll manually costs $200-500/month for a 10-person team. QuickBooks Payroll costs similar to Gusto's Simple plan but lacks the automation and clean interface. ADP RUN (for small businesses) starts around $79/mo base, while their mid-market solution (Workforce Now) costs more but targets larger companies.

Gusto's pricing is competitive for small businesses that don't need extensive add-ons. If you're adding performance reviews, international payroll, and premium support, costs can increase significantly.

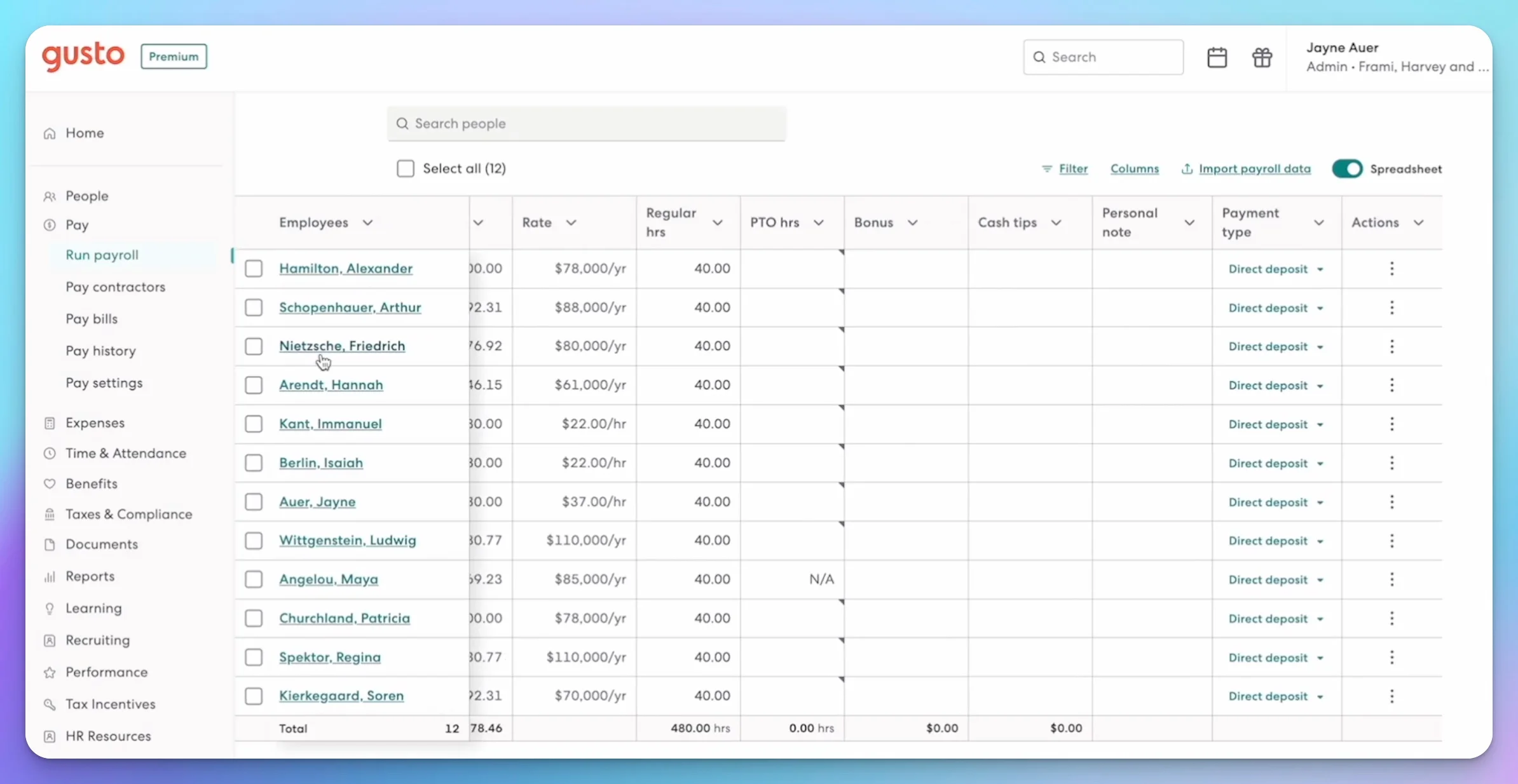

The Core "Auto-Pilot" Experience

Gusto's AutoPilot Payroll feature runs automatically on your schedule once configured, eliminating manual intervention. Once you set your payroll schedule and configure employee defaults, payroll processes automatically unless you make changes. If an employee's hours, PTO, or deductions change, you update them before the payroll deadline. Otherwise, Gusto handles everything—no button to click, no manual review required.

The reliability of AutoPilot is its key value: payroll runs on schedule even if you're unavailable, reducing the risk of missed pay dates or last-minute scrambling.

Time saved: For a 10-person team with consistent salaries, AutoPilot eliminates 2-3 hours of monthly payroll admin. For hourly teams with variable schedules, you still need to review hours, but tax calculations and filing happen automatically.

Automatic Tax Filing (The Real Value)

Every time you run payroll, Gusto:

- Calculates federal, state, and local tax withholdings

- Debits your bank account for employer taxes

- Files all required tax forms electronically

- Handles quarterly and annual filings (940, 941, W-2, 1099)

Automatic tax filing is one of Gusto's most valuable features. Manual tax filing is error-prone and time-consuming, with IRS penalties starting at $50 per form for missed deadlines. Gusto handles all tax filings automatically, reducing compliance risk.

What's covered:

- Federal payroll taxes (FICA, Medicare, federal income tax)

- State income tax withholding (all 50 states)

- Local taxes (city, county where applicable)

- Unemployment insurance (SUTA/FUTA)

- New hire reporting to state agencies

Employee Self-Service Portal

Employees get lifetime access to their Gusto account, even after leaving your company. They can:

- Download paystubs and W-2s

- Update direct deposit information

- Manage tax withholdings (W-4)

- Track PTO balances

- Access benefits information

IT benefit: Employee self-service reduces administrative requests for historical documents. Employees can access their payroll history independently at any time.

Time Savings Reality Check

Gusto's automation saves significant time for consistent payroll (salaried employees, predictable schedules). If you have complex hourly tracking, commission structures, or frequent payroll adjustments, you'll still spend time managing inputs. The automation handles the tax complexity—not the data entry.

The IT Admin's Perspective

Most Gusto reviews focus on HR and payroll features. From an IT perspective, integration capabilities, security workflows, and how Gusto fits into your existing tech stack are equally important considerations.

Google Workspace & Microsoft 365 Integration

Gusto integrates with both Google Workspace and Microsoft 365 through its app directory. This enables automatic email provisioning during employee onboarding.

How it works:

- New hire completes Gusto onboarding

- Gusto creates their email account in Google Workspace or Microsoft 365

- Employee receives login credentials automatically

- Email account is provisioned before their first day

What's NOT automated: Gusto creates the email account, but you still need to handle:

- Group/distribution list assignments

- Application access (Slack, Monday.com, etc.)

- Device enrollment (MDM)

- File storage permissions

Important limitation: Gusto's API connection is unidirectional for provisioning. It handles the 'Create' event perfectly but does not sync 'Update' events for attributes like name changes or organizational units (OUs). If you change an employee's name in Gusto, you must update it manually in Google Admin Console or Microsoft 365 Admin Center. This is a common limitation with HR-to-identity integrations and requires maintaining two sources of truth for employee data.

IT perspective: The email provisioning saves 10-15 minutes per new hire, though it's not a complete onboarding automation solution. You'll still need a separate IT onboarding checklist for application access and device setup.

For a more complete onboarding workflow, see our guide on hiring your first employee.

Device Management & Offboarding Security

Gusto doesn't offer native MDM (Mobile Device Management), but it does track company-owned devices assigned to employees. During offboarding, Gusto generates a checklist that includes:

- Device retrieval reminder

- Email account deactivation

- Benefits termination

- Final paycheck processing

Important note: Gusto provides device retrieval reminders but doesn't enforce retrieval. You'll need a separate process to:

- Remotely wipe company data from devices

- Revoke application access

- Disable VPN credentials

- Remove from Google Workspace/M365

If you're using Apple Business Manager for Mac deployments, Gusto won't integrate with your MDM workflow. You'll need to manually cross-reference Gusto's offboarding list with your device inventory.

Does Gusto Include Time Tracking?

Yes, Gusto includes time tracking and project-based workforce costing on Plus and Premium plans. Employees can clock in/out via web browser, mobile app, or kiosk mode (tablet at job site).

What it tracks:

- Regular hours and overtime (automatic calculation)

- Hours assigned to specific projects for labor cost reporting

- PTO usage and break times (for compliance)

- Workforce costing by project, department, or location

What it lacks:

- Advanced job costing features found in QuickBooks Desktop (union-specific codes, complex overhead allocation)

- Client billing integration

- Task-level time tracking for project management

IT perspective: Gusto's project tracking works well for service businesses that need basic labor cost allocation. Construction companies requiring certified payroll or union-specific reporting may find QuickBooks Desktop or specialized construction software more suitable.

Speed test: Average time to run payroll for 10 employees with project allocations: 45 seconds (tested in our review).

Security & Compliance: The IT Admin Checklist

Beyond payroll features, IT administrators need to vet Gusto's security posture. Here's the technical breakdown:

SOC 2 Type II Compliance: Gusto maintains SOC 2 Type II certification. Admins can request the latest audit report directly through the Gusto Trust Center. This is essential for companies undergoing their own compliance audits or working with enterprise clients that require vendor security documentation.

SSO & MFA:

- Two-factor authentication (2FA): Mandatory for all admin accounts

- Google Sign-In: Supported natively for all plans

- SAML SSO: Available for enterprise identity providers (Okta, OneLogin, Azure AD) but typically requires the Premium plan ($180/mo base)

- MFA enforcement: Can be required company-wide through admin settings

Compliance Automation Integrations: If your company is pursuing SOC 2, ISO 27001, or other compliance certifications, Gusto integrates with compliance automation platforms:

- Secureframe: Automatically syncs employee onboarding/offboarding evidence

- Vanta: Pulls HR data for continuous compliance monitoring

- Drata: Automates employee access reviews and background check verification

These integrations save hours of manual screenshot collection and evidence gathering during audits.

Data Security Features:

- Encryption: Data encrypted at rest (AES-256) and in transit (TLS 1.2+)

- Access controls: Role-based permissions for admin, payroll, and HR functions

- Audit logs: Track all payroll changes and admin actions (Premium plan)

- Bank-level security: Gusto uses the same security standards as financial institutions

What's Missing:

- No native MDM integration: Gusto tracks device assignments but doesn't enforce remote wipe or device compliance policies

- Limited API access on lower tiers: Custom integrations require Premium plan for full API access

- No on-premise option: Cloud-only SaaS model (not suitable for air-gapped environments)

Compliance Tip

For companies with strict data residency requirements, note that Gusto stores data in U.S.-based AWS data centers. If you need EU data residency for GDPR compliance, consider Deel or Rippling's international solutions.

Integration Ecosystem

Gusto integrates with 180+ applications, including:

- Accounting: QuickBooks Online, Xero, Wave

- HR: BambooHR, Zenefits

- Benefits: Health insurance brokers, 401(k) providers

- Productivity: Slack, Microsoft Teams (notifications only)

What's missing: Gusto doesn't integrate with:

- Project management tools (Monday.com, Asana, ClickUp)

- CRM systems (Salesforce, HubSpot)

- Expense management (Expensify, Divvy)

For a complete business software stack, you'll need separate tools for project management and expense tracking.

If you're using Xero for accounting, Gusto integrates seamlessly for payroll sync. QuickBooks Online users can also connect via the QuickBooks integration.

Hidden Integration Costs

While Gusto's base pricing includes core integrations, third-party services often add fees:

- 401(k) provider sync: $5-10/mo per participant (charged by 401(k) provider, not Gusto)

- Health insurance broker integration: Typically included, but premium changes may trigger manual reconciliation

- Advanced accounting sync: QuickBooks Online and Xero sync is included; custom API usage may require Premium plan

- Time tracking hardware: Kiosk mode is free, but tablets/time clocks are separate purchases

Budget reality: For a 15-person team with 401(k) and health insurance, expect an additional $75-150/mo in third-party integration fees beyond Gusto's base cost.

Note on workers' compensation: Gusto's pay-as-you-go workers' comp integration typically has no additional integration fees—you pay only the actual workers' comp premium based on payroll.

Migrating from QuickBooks to Gusto: IT Admin Checklist

If you're switching from QuickBooks Payroll to Gusto, follow this sequence to avoid tax filing gaps:

2-3 weeks before migration:

- Export employee list from QuickBooks (names, addresses, SSNs, pay rates)

- Download year-to-date payroll reports (for tax reconciliation)

- Close out any pending reimbursements or adjustments

- Notify employees of upcoming payroll system change

1 week before migration:

- Run final payroll in QuickBooks

- Void any uncashed checks older than 90 days

- Export final tax liability reports (federal, state, local)

- Set up Gusto account and import employee data

Migration week:

- Verify all employee data in Gusto (bank accounts, tax withholdings)

- Run test payroll in Gusto (use "preview" mode)

- Confirm bank account connection for direct deposit

- Update Google Workspace/M365 provisioning settings

Post-migration:

- Run first live payroll in Gusto

- Verify tax deposits match QuickBooks final liabilities

- Archive QuickBooks payroll data (7-year retention required)

- Update IT onboarding checklist to reference Gusto

Common migration issues:

- Tax liability mismatch: Gusto assumes clean slate; manually reconcile any outstanding QuickBooks liabilities

- PTO balance transfer: Must be manually entered in Gusto (no automatic import)

- Historical data: Gusto doesn't import prior-year W-2s; keep QuickBooks access for historical records

For complete migration guidance, see our hiring your first employee guide.

Video Guide: How to Move to Gusto

Watch this step-by-step walkthrough of migrating your payroll to Gusto:

IT Admin Feature Comparison

| Feature | Simple Plan | Plus Plan | Premium Plan |

|---|---|---|---|

| Google Workspace sync | ✅ | ✅ | ✅ |

| Microsoft 365 sync | ✅ | ✅ | ✅ |

| Time tracking | ❌ | ✅ | ✅ |

| Multi-state payroll | ❌ | ✅ | ✅ |

| API access | Limited | Limited | Full |

| Custom reports | ❌ | ❌ | ✅ |

| Dedicated support | ❌ | ❌ | ✅ |

Integration Reality Check

Gusto's integrations are solid for accounting and benefits, but weak for operational tools. If you're running a tech-forward company with heavy Slack/project management usage, Gusto won't be your central hub. It's a payroll system that integrates with your stack—not a platform that replaces it.

Does Gusto Have Phone Support?

All Gusto plans include phone support, typically via callback request during business hours. The Premium plan ($180/mo base) provides priority phone access and a dedicated customer success manager. Simple and Plus plan users can access standard phone support and chat, though wait times vary depending on volume.

Support Tiers by Plan

Simple Plan:

- Phone support via callback request

- Email and chat support

- Response time: 24-48 hours

- Self-service knowledge base

Plus Plan:

- Phone support via callback request

- Email and chat support

- Priority queue (faster than Simple)

- Response time: 12-24 hours

Premium Plan:

- Dedicated service advisor (named contact)

- Phone support included

- Access to certified HR experts

- Response time: Same-day for urgent issues

- Onboarding assistance and payroll migration help

Real-World Support Experience

Based on user reviews and our testing:

What works:

- Knowledge base is comprehensive and well-organized

- Chat support is responsive for simple questions (password resets, basic setup)

- Tax filing issues get escalated quickly (Gusto's liability)

Areas for improvement:

- Complex questions may require multiple exchanges to resolve

- Phone support wait times can be longer on Simple and Plus plans during peak periods

- Simple and Plus plans have limited onboarding assistance

- Dedicated account managers are only available on Premium

Comparison to competitors:

- QuickBooks Payroll: Phone support is nearly impossible to reach; Gusto's chat is faster

- ADP: Better phone support, but costs significantly more

- OnPay: Similar chat support, slightly faster response times

Support Tier Reality

All plans include phone support via callback, but wait times can be longer on Simple and Plus plans during peak periods. Premium plan users get priority access and a dedicated customer success manager. For time-sensitive payroll issues, plan ahead or consider Premium if immediate phone access is critical.

When Support Matters Most

Support quality is critical during:

- Initial setup: Migrating from another payroll system

- Tax issues: Incorrect filings or IRS notices

- Benefits enrollment: Open enrollment periods

- Offboarding: Final paycheck calculations and compliance

Simple and Plus plan users will primarily use the knowledge base and chat support. Premium plan support includes dedicated assistance, which comes at a higher monthly cost.

Gusto vs. The World

How does Gusto stack up against the major payroll competitors? Here's the honest comparison.

Gusto vs. QuickBooks Payroll

When QuickBooks wins:

- You're already using QuickBooks Desktop for complex job costing

- You need construction-specific payroll features (union rates, certified payroll)

- You have heavy integration with QuickBooks accounting

When Gusto wins:

- You want a modern, clean interface (QuickBooks feels dated)

- You need better support (Gusto's chat beats QuickBooks' phone maze)

- You're starting fresh or using Xero or Wave for accounting

Pricing comparison (10 employees):

- QuickBooks Payroll Core: $45/mo + $5/employee = $95/mo

- Gusto Simple: $49/mo + $6/employee = $109/mo

- Winner: QuickBooks by $14/mo, but Gusto's interface and support justify the premium

For a detailed comparison, see our QuickBooks vs. Xero guide and QuickBooks Desktop alternatives.

Gusto vs. ADP

When ADP wins:

- You have 100+ employees (ADP's sweet spot)

- You need enterprise-grade reporting and analytics

- You require dedicated account management

When Gusto wins:

- You have under 50 employees (ADP is overkill)

- You want self-service setup (ADP requires sales calls)

- You need modern integrations (Google Workspace, Slack)

Pricing comparison (25 employees):

- ADP RUN: ~$79/mo base + $8/employee = $279/mo (often requires annual contract)

- Gusto Plus: $80/mo + $12/employee = $380/mo (month-to-month)

- Winner: ADP RUN on price, but Gusto offers more transparent pricing and flexibility

ADP serves established companies with complex needs, while Gusto is designed for growing businesses that prioritize flexibility and ease of use.

Gusto vs. Deel/Rippling (International Teams)

When Deel/Rippling wins:

- You have employees in multiple countries

- You need Employer of Record (EOR) services

- You're hiring internationally from day one

When Gusto wins:

- You're primarily U.S.-based with occasional international contractors

- You don't need full EOR services

- You want simpler pricing (Deel/Rippling are complex)

Gusto Global pricing: $599/mo per international employee (promotional rate through 2026, normally $699). This is competitive with Deel for 1-2 international employees, but Deel wins at scale.

Verdict: Gusto is catching up with Gusto Global, but Deel and Rippling are still better for international-first companies.

Comparison Table

| Feature | Gusto | QuickBooks Payroll | ADP | Deel/Rippling |

|---|---|---|---|---|

| Best for | 1-50 employees | QB Desktop users | 100+ employees | International teams |

| Starting price | $49/mo + $6/person | $45/mo + $5/person | $150/mo + $8/person | $599/mo per intl employee |

| Interface | Modern, clean | Dated | Enterprise | Modern |

| Support | Chat (phone on Premium) | Phone (hard to reach) | Dedicated rep | Chat + phone |

| Integrations | 180+ apps | QuickBooks ecosystem | Limited | 500+ apps |

| International | Gusto Global ($599/person) | Not available | Available | Core feature |

| Setup time | 30 minutes | 1-2 hours | Requires sales call | 1-2 hours |

Who Should SKIP Gusto?

Gusto is excellent for most small businesses, but it's not the right fit for everyone. Here's when to look elsewhere.

Complex Manufacturing or Construction

If you need:

- Union-specific payroll rules and certified payroll reporting

- Complex job costing with payroll allocated to specific projects

- Prevailing wage calculations for government contracts

- Multi-tier overtime rules (double-time, shift differentials)

Use instead: QuickBooks Desktop with Payroll or ADP Workforce Now. These systems handle construction-specific compliance and job costing that Gusto doesn't support.

The "Paper Check" Business

If your employees:

- Don't have email addresses or smartphones

- Prefer paper checks over direct deposit

- Work in environments without internet access

Use instead: A local payroll service or accountant who can print and distribute physical checks. Gusto is digital-first and assumes employees have email access.

Heavy QuickBooks Desktop Integration

If you're running:

- QuickBooks Desktop Premier or Enterprise

- Complex inventory tracking tied to labor costs

- Multi-entity accounting with consolidated reporting

Use instead: Stick with QuickBooks Payroll. The integration is tighter, and migrating to Gusto means losing some accounting workflow efficiency.

International-First Companies

If you're hiring:

- Employees in 5+ countries from day one

- Full-time international employees (not just contractors)

- Teams where international headcount exceeds U.S. headcount

Use instead: Deel or Rippling. Gusto Global works for 1-2 international employees, but it's not built for international-first companies.

Businesses Requiring Custom Payroll Rules

If you need:

- Custom deduction formulas not supported by standard payroll

- Industry-specific compliance (healthcare, legal, finance)

- Integration with legacy HR systems

Use instead: ADP or Paychex with custom implementation. These enterprise systems offer more flexibility for non-standard payroll requirements.

Real-World Use Cases: Who Gusto Works Best For

Now that we've covered who should skip Gusto, here's who it's perfect for.

Remote-First Agency (Plus Plan Sweet Spot)

Profile: 12-person marketing agency, employees in 4 states, project-based work

Why Gusto works:

- Multi-state payroll included in Plus plan ($80/mo base)

- Google Workspace integration for email provisioning

- Simple time tracking for billable hours (though not project-level)

- Clean interface for distributed team

Monthly cost: $80 base + (12 × $12) = $224/mo

Alternative considered: Rippling (more expensive, overkill for U.S.-only team)

Retail/Cafe with Hourly Workers

Profile: Coffee shop with 8 part-time employees, variable schedules, single location

Why Gusto works:

- Kiosk mode for tablet-based clock-in/out

- Automatic overtime calculations

- Simple plan sufficient (single-state)

- Employee self-service reduces admin questions

Monthly cost: $49 base + (8 × $6) = $97/mo

Alternative considered: Square Payroll (similar pricing, but Gusto has better tax filing)

Contractor-Heavy Consulting Firm

Profile: Solo consultant with 6 freelance contractors, no W-2 employees

Why Gusto works:

- Contractor-only plan is cost-effective

- Automatic 1099 generation

- Unlimited contractor payments

- No need for full payroll features

Monthly cost: $35 base + (6 × $6) = $71/mo

Alternative considered: Wave Payroll (cheaper but less reliable tax filing)

Multi-State Expansion Scenario

Profile: 20-person SaaS company expanding from California to Texas and Florida

Why Gusto works:

- Plus plan handles multi-state payroll automatically

- State tax registration included (no extra fees)

- Compliance alerts for new state requirements

- Scales easily as team grows

Monthly cost: $80 base + (20 × $12) = $320/mo

Alternative considered: ADP (requires annual contract, more expensive)

Conclusion & Verdict

Gusto provides automated payroll with reliable tax filing and clean integrations. The AutoPilot payroll and automatic tax compliance address the two main challenges of manual payroll: time consumption and IRS penalty risk.

Final Recommendations by Business Type

Solopreneurs with contractors: Use the Contractor-Only plan ($35/mo base). It's the most cost-effective way to handle 1099 payments and tax forms.

Small teams (1-10 employees, single state): Start with the Simple plan ($49/mo base). Upgrade to Plus when you hire across state lines or need time tracking.

Growing companies (10-50 employees, multi-state): The Plus plan ($80/mo base) is the sweet spot. You get multi-state payroll, time tracking, and next-day pay without Premium plan costs.

Established businesses (50+ employees): Consider the Premium plan ($180/mo base) for dedicated support, or evaluate ADP if you need enterprise features.

What Gusto Does Best

- Automatic tax filing: Reduces IRS penalty risk

- Clean interface: User-friendly payroll software

- Employee self-service: Reduces administrative requests

- Google Workspace/M365 integration: Streamlines onboarding

What Gusto Doesn't Do Well

- Priority phone support: Dedicated CSM requires Premium plan ($180/mo)

- Advanced time tracking: Limited for detailed project management

- International payroll: Gusto Global available, but Deel/Rippling offer more features

- Complex job costing: QuickBooks Desktop better for construction

The Bottom Line

For U.S.-based small businesses with straightforward payroll needs, Gusto offers a strong solution. The pricing is transparent, the automation is reliable, and the interface is user-friendly. Most businesses save 2-4 hours per month on payroll administration.

Businesses requiring complex job costing, extensive international hiring, or phone support without Premium plan costs should evaluate alternative solutions.

iFeelTech Verdict

Rating: 4.3/5

Gusto is the best payroll software for small businesses that want automation without complexity. The Plus plan ($80/mo base) offers the best value for growing teams. Deduct points for longer support wait times on lower tiers. Add points for tax filing reliability, project-based time tracking, and clean integrations.

Best for: 5-50 employee companies, remote teams, service businesses

Skip if: Construction requiring certified payroll, international-first companies, businesses requiring dedicated account management

Next steps: If you're migrating from QuickBooks, read our QuickBooks Desktop alternatives guide. For complete business software recommendations, see our essential business software stack.

Related Articles

More from Business Software

QuickBooks StackSocial "Lifetime" Deal vs QuickBooks Online: Which Makes Sense for Your Business?

Complete analysis of StackSocial's QuickBooks Desktop Pro Plus 2024 deal ($199.97) versus QuickBooks Online subscription. Compare costs, features, limitations, and find the best option for your business.

11 min read

When Trust Breaks: Our Experience Leaving Harvest and Building a Replacement

How a price increase led us to cancel Harvest and build our own time tracker in hours using AI-assisted coding. A real story about vibecoding and the changing dynamics of subscription software.

4 min read

Best Cloud Storage for Small Business 2026: Security, Performance & Cost

Find the right cloud solution: ecosystem giants vs privacy-first alternatives vs specialized workflows. Expert analysis of OneDrive, Google Drive, Proton, and more.

21 min read