Hiring Your First Employee: Payroll Setup Guide (2026)

Complete payroll setup guide for your first employee. Gusto vs QuickBooks comparison, legal requirements, tax compliance, and step-by-step setup process. Understand costs, timelines, and compliance requirements.

What to Expect: First-Time Payroll Setup

Payroll compliance requires more planning than most business owners anticipate. From our experience helping South Florida businesses establish payroll processes, we've found that first-time employers often focus on the monthly platform cost ($40-50) without fully understanding the broader requirements: EIN registration, state tax setup, proper worker classification, and ongoing filing obligations.

Successful payroll setup typically comes down to understanding these requirements upfront and choosing software that automates the complex parts. This guide walks through the complete process, from obtaining your EIN to processing your first paycheck.

Affiliate Disclosure: This article contains affiliate links. If you make a purchase through these links, we may earn a small commission at no extra cost to you.

Hiring Your First Employee: Payroll Setup Overview

What Makes Payroll Complicated for First-Time Employers

When you're a solopreneur, taxes are straightforward: quarterly estimated payments, one Social Security number, done. Add an employee, and suddenly you're responsible for:

Tax withholding and remittance:

- Federal income tax (based on employee W-4)

- Social Security (6.2% employer + 6.2% employee = 12.4% total)

- Medicare (1.45% employer + 1.45% employee = 2.9% total)

- Federal Unemployment Tax (FUTA, employer-only)

- State income tax withholding (43 states)

- State unemployment insurance (SUTA, varies by state)

- Local taxes (some cities and counties)

Reporting obligations:

- Form 941 (quarterly federal tax return)

- Form 940 (annual FUTA return)

- W-2 forms (annual, due January 31)

- New hire reporting (within 20 days to state)

- State quarterly returns

- Year-end reconciliation

Common compliance challenges:

| Mistake | Frequency | Average Penalty |

|---|---|---|

| Late tax filing | 40% of businesses | 5% per month, max 25% |

| Late tax payment | 40% of businesses | 2-10% depending on delay |

| Employee misclassification | 30% of businesses | $50,000+ in back wages + penalties |

| Trust Fund Recovery Penalty | Rare but severe | 100% of withheld taxes (personally liable) |

The solution: Payroll software that automates calculations, files forms, and remits payments. This guide compares Gusto vs QuickBooks and walks through setup.

Before You Hire: Legal Requirements Checklist

Completing these preparatory steps before hiring helps ensure a smooth payroll process.

Federal Requirements (Must Complete First)

| Requirement | Timeline | Cost | How to Apply |

|---|---|---|---|

| Employer Identification Number (EIN) | Before first paycheck | Free | IRS.gov online application (10 minutes, instant approval) |

| Business bank account | Before first payroll | Varies | Use EIN to open at your bank |

| Form I-9 (Employment Eligibility) | Within 3 business days of hire | Free | Download from USCIS, store for 3 years |

| Form W-4 (Tax Withholding) | Before first paycheck | Free | Employee completes, you store with payroll records |

2026-Specific Updates:

- Social Security wage base: $184,500 (up from $176,100 in 2025)

- New W-2 reporting: Box 12, Code TT required for qualified overtime compensation

- Dependent care FSA limit: Increased to $7,500 (from $5,000)

- W-4 exemption renewals: Employees claiming "exempt" must file new W-4 by February 15, 2026

EIN Is Essential

Your EIN is like a Social Security number for your business. You cannot process payroll, file taxes, or report new hires without it. Apply at IRS.gov—the application is free and approval is instant for online applications.

State Requirements (Varies Significantly)

Every state has different requirements, but common obligations include:

State tax registration:

- State income tax withholding ID (if your state has income tax)

- State unemployment insurance (SUTA) registration

- New hire reporting registry (deadline varies: 7-20 days depending on state)

Required state insurance:

- Workers' compensation: Mandatory in most states for even one employee (check your state's requirement)

- State unemployment insurance: You contribute to the state unemployment fund

- State disability insurance: Required only in CA, NY, NJ, RI, HI, and Puerto Rico

Where to register: Each state has a different process. In California, for example, you register with the Employment Development Department (EDD). In New York, it's the Department of Labor. Search "[Your State] new employer registration" to find the correct agency.

Budget Planning: The 25-40% Rule

Beyond salary, plan for employer-paid taxes. These are YOUR obligation as the employer, not deductions from the employee's paycheck:

Example: $50,000 annual salary

- Social Security (employer portion): 6.2% = $3,100

- Medicare (employer portion): 1.45% = $725

- Federal Unemployment (FUTA): 0.6% on first $7,000 = $42

- State Unemployment (SUTA): 0.5-10% depending on state = $250-5,000

Total employer taxes: $4,117-8,867 (8.75-18% of salary)

This doesn't include health insurance, retirement contributions, or other benefits. The "25-40% rule" means budgeting 25-40% above the employee's salary for all employer costs.

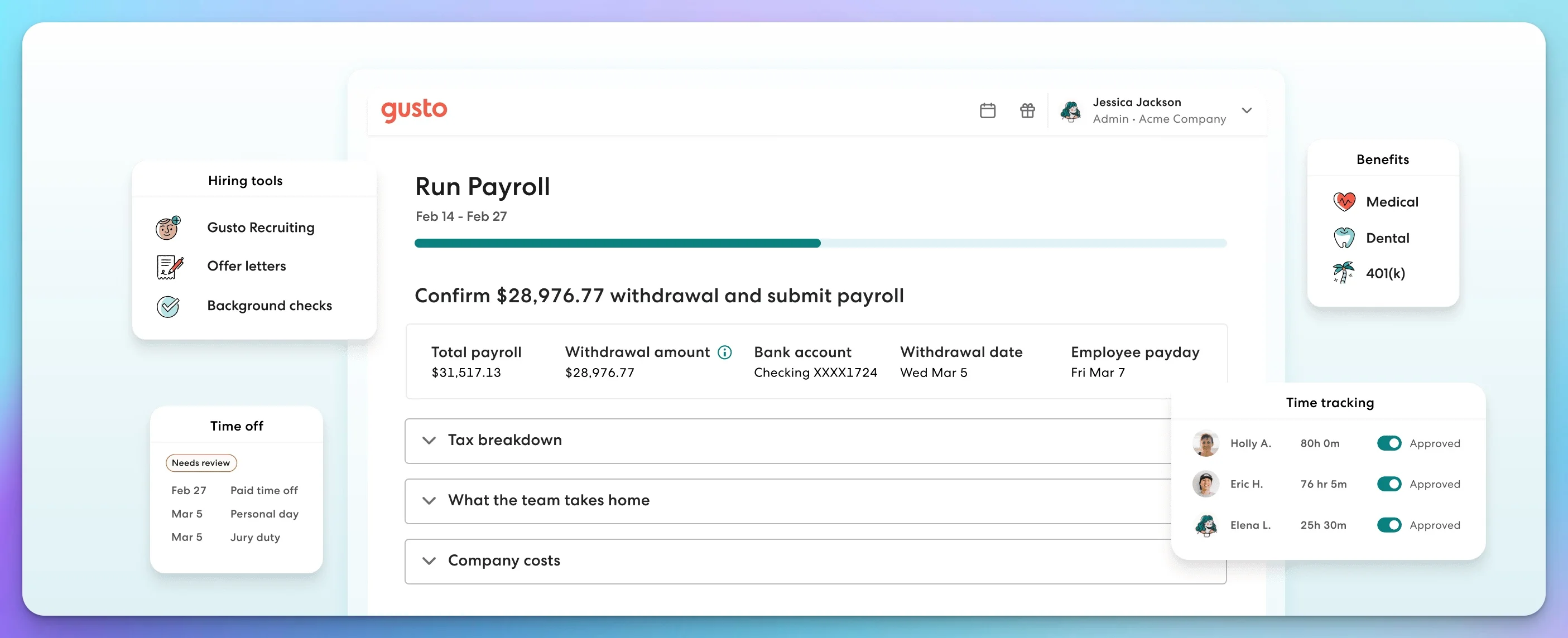

Gusto vs QuickBooks: Platform Comparison

Choosing payroll software represents one of the most impactful decisions for first-time employers. The right platform automates tax calculations, files returns, and prevents the errors that lead to penalties.

Side-by-Side Comparison

| Feature | Gusto Simple | QuickBooks Core | Winner |

|---|---|---|---|

| Monthly Base | $40-49 | $45-50 | Tie |

| Per Employee | $6 | $4-6.50 | QuickBooks |

| Tax Filing | Automatic (federal, state, local) | Automatic (federal, state, local) | Tie |

| New Hire Reporting | Included | Included | Tie |

| Direct Deposit | Next-day | Next-day | Tie |

| Multi-State Support | Plus plan ($80/mo) | Included in Core | QuickBooks |

| User Interface | Exceptionally intuitive | Familiar if using QuickBooks | Gusto |

| HR Tools | Time off tracking, onboarding checklists | Basic | Gusto |

| Accounting Integration | Limited | Seamless with QuickBooks Online | QuickBooks |

| Tax Penalty Protection | Not included | Elite plan ($25k guarantee) | QuickBooks |

| Customer Support | Email, chat | Email, chat, phone | Tie |

For your first employee in a single state: Gusto Simple ($40-49/month) + $6/person = $46-55/month total

Decision Framework

Choose Gusto if:

- You're not currently using QuickBooks for accounting

- You value the simplest possible payroll experience

- You want integrated HR features (PTO tracking, onboarding templates)

- You run a single-state operation

- User experience matters more than cost

Choose QuickBooks Payroll if:

- You already use QuickBooks Online for accounting (seamless integration)

- You need multi-state payroll from the start

- You want tax penalty protection ($25,000 guarantee on Elite plan)

- You prefer staying in one ecosystem

For additional accounting software context beyond payroll, see our QuickBooks vs Xero comparison.

Payroll Setup: Step-by-Step (72 Hours)

This walkthrough uses Gusto as the example, though QuickBooks follows similar steps. The entire process takes about 3-5 hours spread over 3 days.

Day 1: Platform Setup (2 Hours)

Hour 1: Company configuration

-

Visit Gusto.com and select "Simple" plan

-

Enter business information:

- Legal business name (exactly as on EIN application)

- EIN (9-digit number)

- Business address

- Industry classification

- Business type (LLC, S-Corp, sole proprietorship)

-

Connect bank account:

- Gusto will debit your account for payroll

- Requires bank routing number and account number

- Verify with micro-deposits (small test transactions)

-

Choose pay schedule:

- Bi-weekly: Every two weeks (26 pay periods/year) — most common

- Semi-monthly: Twice per month, usually 1st and 15th (24 pay periods/year)

- Weekly: Every week (52 pay periods/year) — rare for salaried

- Monthly: Once per month (12 pay periods/year) — usually only for contractors

Hour 2: State tax setup

Gusto automatically identifies which states require registration based on your business location and where employees work. Complete the registration links for:

- State unemployment insurance (SUTA)

- State income tax withholding

- State disability insurance (if applicable: CA, NY, NJ, RI, HI)

- Workers' compensation insurance provider information

Store confirmation numbers and registration dates—you'll need these for quarterly filings.

Day 2: Employee Enrollment (2 Hours)

Add your first employee:

-

Click "Add Employee" in Gusto dashboard

-

Enter basic information:

- Full legal name (as on Social Security card)

- Address

- Date of birth

- Social Security number

- Phone number and email

-

Set compensation:

- Hourly or salary: Choose based on role

- Pay rate: Enter hourly rate or annual salary

- Overtime eligible? Non-exempt employees qualify for 1.5x overtime

- Pay schedule: Confirm it matches your company setting

-

Send electronic enrollment:

- Gusto emails the employee a secure link

- Employee completes Form W-4 electronically

- Employee enters direct deposit information (bank routing + account number)

- Employee completes state withholding forms if applicable

Form I-9 completion:

Remember, Form I-9 must be completed within three business days of hire. Gusto provides I-9 workflows, but note:

- You must physically inspect original documents (passport, driver's license + Social Security card, etc.)

- You cannot accept photocopies or scanned documents for initial verification

- You store Form I-9 (not filed with government) for 3 years after hire or 1 year after termination, whichever is later

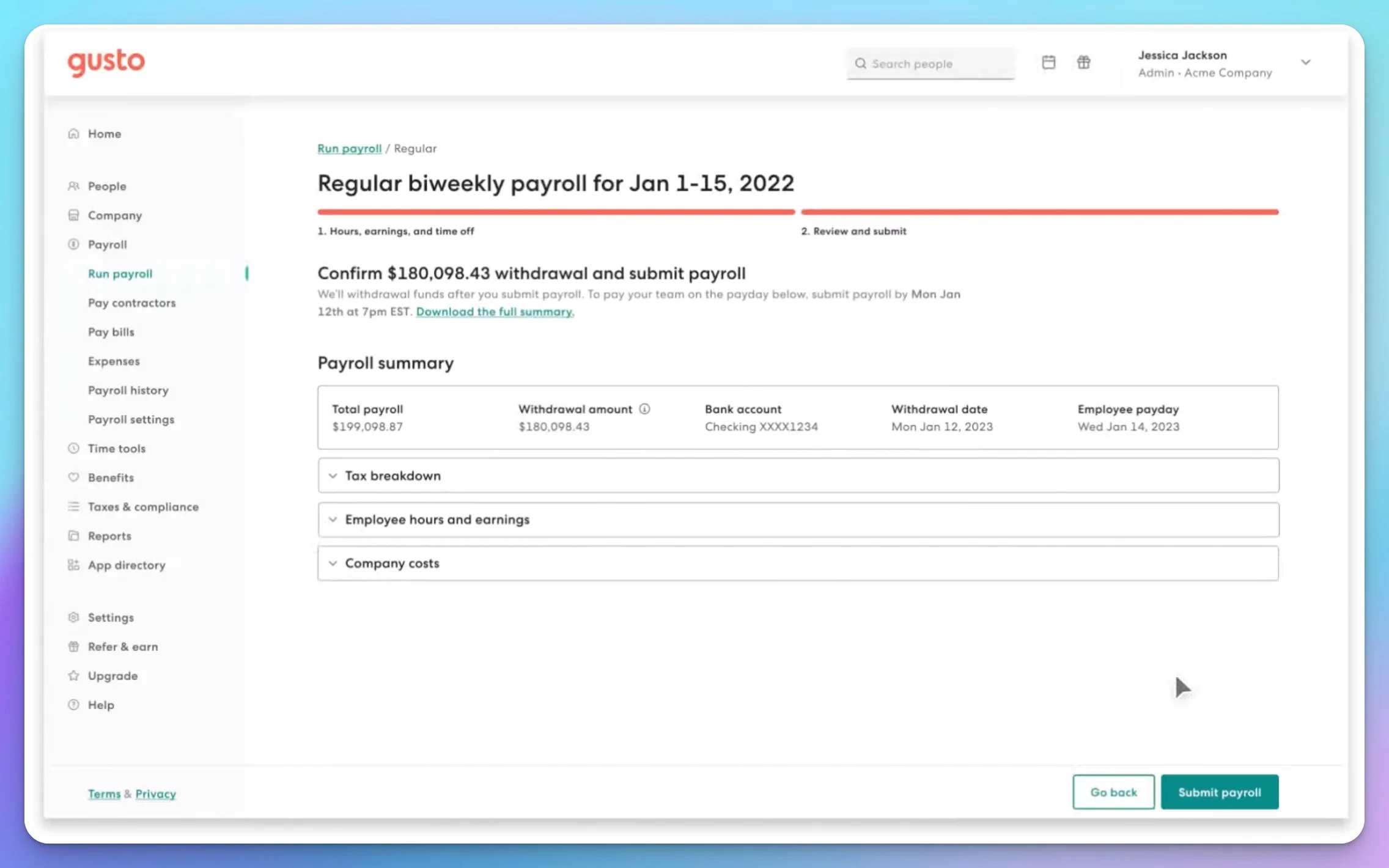

Day 3: First Payroll Test Run (1 Hour)

Before processing a real paycheck, run a test:

-

Create a test employee with a hypothetical salary

-

Process a complete payroll cycle

-

Review the calculations:

- Gross pay (salary or hours × rate)

- Federal income tax withholding (based on W-4)

- Social Security withholding (6.2% of gross, up to wage base)

- Medicare withholding (1.45% of gross)

- State income tax withholding (if applicable)

- Net pay (what employee receives)

-

Verify the timeline:

- When will the employee receive funds?

- When will your bank account be debited?

- Budget for 1-2 day lead time

-

Delete the test employee before running real payroll

Process your first real payroll:

- Confirm employee information is accurate

- Enter hours worked (for hourly) or verify salary amount

- Add any bonuses, reimbursements, or deductions

- Review the payroll summary carefully

- Submit (Gusto processes overnight)

Timing Tip

If the pay date is Friday, January 10, and you use next-day direct deposit, submit payroll by end of business Thursday, January 9. Your bank account will be debited 1-2 days before employees receive funds. Plan your cash flow accordingly.

Understanding Worker Classification

Properly classifying workers as employees versus independent contractors is one of the most important compliance decisions you'll make.

The IRS control test examines:

- Behavioral control: Do you direct how, when, and where work is performed?

- Financial control: Do you provide tools, cover expenses, determine payment methods?

- Relationship type: Is there a written contract? Are benefits provided? Is this indefinite or project-based?

If you control these factors, the worker is likely an employee, not a contractor.

Real penalty example: A Miami consulting firm classified their administrative assistant as a 1099 contractor for three years. IRS audit determined they should have been W-2:

- Employer-side payroll taxes owed: $15,000

- Employee-side taxes not withheld: $12,000

- Penalties and interest: $18,000

- Legal and accounting fees: $8,000

- Total: $53,000

When classification is uncertain, W-2 employee status is generally the safer choice. The added administrative work is typically less burdensome than potential reclassification issues.

Common Payroll Mistakes to Anticipate

Understanding common errors helps you avoid them from the start.

| Mistake | Frequency | Average Cost | How to Avoid |

|---|---|---|---|

| Late tax filing | 40% annually | 5% per month, max 25% of taxes | Use automatic filing in Gusto/QuickBooks |

| Late tax payment | 40% annually | 2-10% + interest | Set up auto-payment through EFTPS |

| Misclassifying workers | 30% of businesses | $50,000+ average | Use IRS control test, classify as W-2 when uncertain |

| Incorrect overtime calculations | 25% of businesses | Back wages + DOL fines | Properly designate exempt vs non-exempt |

| Missing new hire reports | 20% of businesses | $25-500 per unreported worker | Payroll platform auto-reports in most states |

| Using withheld taxes for operations | Rare but severe | 100% penalty + personal liability | Never "borrow" from payroll tax fund |

Worth noting: On average, each payroll error requires about $291 to correct when accounting for administrative time, amended filings, and potential penalties. Automated platforms help minimize these occurrences.

First-Year Payroll Costs Breakdown

Understanding the complete investment helps realistic budgeting.

Platform Costs (One Employee, Single State)

| Platform | Monthly Cost | Annual Cost |

|---|---|---|

| Gusto Simple | $46-55 ($40-49 base + $6/person) | $552-660 |

| QuickBooks Core | $49-57 ($45-50 base + $4-6.50/person) | $588-684 |

Additional first-year costs:

- Workers' compensation insurance: $200-800 (varies dramatically by state and industry)

- State unemployment insurance: Included in payroll taxes

- Accounting/bookkeeping: $500-1,500 if outsourced (optional)

Total payroll administration first year: $1,252-2,984 excluding the actual salary and employer taxes.

Employer Tax Obligations (Example: $50,000 Salary)

Remember, these are YOUR costs as the employer, not deductions from the employee's paycheck:

| Tax | Rate | Annual Cost |

|---|---|---|

| Social Security | 6.2% on first $184,500 | $3,100 |

| Medicare | 1.45% (no cap) | $725 |

| Federal Unemployment (FUTA) | 0.6% on first $7,000 | $42 |

| State Unemployment (SUTA) | 0.5-10% (varies by state) | $250-5,000 |

| Total Employer Taxes | 8.75-18% | $4,117-8,867 |

Grand total to employ someone at $50,000 salary:

- Base salary: $50,000

- Employer taxes: $4,117-8,867

- Payroll platform: $552-684

- Workers' comp: $200-800

- Total: $54,869-$59,551 (110-119% of base salary)

This doesn't include health insurance, retirement contributions, or other benefits. The rule of thumb: budget 125-140% of salary for total employment cost when including all benefits.

After Your First Paycheck: Ongoing Obligations

Payroll isn't set-it-and-forget-it. Ongoing responsibilities include:

Monthly:

- Process payroll on schedule (bi-weekly or semi-monthly)

- Review automated tax filings for accuracy

Quarterly:

- Form 941 (federal tax return) — due April 30, July 31, October 31, January 31

- State quarterly returns (varies by state)

- Review year-to-date totals for accuracy

Annually:

- Form 940 (federal unemployment tax) — due January 31

- W-2 forms for employees — due January 31

- W-3 form (transmittal to SSA) — due January 31

- Year-end reconciliation

- Update for new tax rates and wage bases

The advantage of Gusto/QuickBooks: These platforms automate most filings. You review and approve rather than manually completing forms.

FAQs: New Employer Questions

Q: Can I switch payroll providers later if I don't like my choice?

A: Yes. Most businesses switch during year-end (December/January) to avoid mid-year reconciliation complexity. Export your year-to-date data from the old platform and import into the new one. Both Gusto and QuickBooks have migration tools.

Q: What if my employee works in a different state than my business?

A: You'll need to register for payroll taxes in the employee's work state, not just your business location state. This is why multi-state support matters. Gusto requires the Plus plan ($80/mo) for multi-state; QuickBooks includes it in Core.

Q: How long do I need to keep payroll records?

A: The IRS requires 4 years. Some states require longer. Store: payroll registers, W-2s, W-4s, I-9s, tax returns, and payment confirmations. Gusto and QuickBooks maintain digital records indefinitely while you're a customer.

Q: What happens during an IRS payroll audit?

A: The IRS will request payroll records, tax deposits, and filed returns for the audit period (typically 3 years). Having complete records from Gusto/QuickBooks makes this process straightforward. If you've used automated filing and payment, you'll have minimal issues.

Q: Should I handle payroll in-house or hire a bookkeeper?

A: For one employee, in-house with Gusto/QuickBooks is usually sufficient and cost-effective. Consider outsourcing when you have 5+ employees, multi-state operations, or complex benefits. Our experience shows the sweet spot for outsourcing is around 10-15 employees.

For IT-related employee onboarding (email setup, computer configuration, security training), see our comprehensive New Employee IT Onboarding Security Checklist.

Related Resources

- QuickBooks vs Xero Comparison - Accounting platform options beyond payroll

- Small Business IT Budget Planning - Annual technology budgeting guide

- New Employee IT Onboarding Security Checklist - Complete IT setup and security procedures

- Small Business Security Compliance Guide - Regulatory framework overview

Need help setting up compliant payroll for your first employee? Our team provides comprehensive onboarding support for businesses throughout South Florida. Contact us to discuss your hiring plans and ensure error-free payroll setup from day one.

Related Articles

More from IT Guides

New Employee IT Onboarding Checklist: Security-First Setup Guide

Complete IT onboarding checklist for small businesses. Secure employee setup from day one with hardware, software, accounts, and training steps that protect your business.

29 min read

The 3-2-1 Backup Rule: Why It Still Works and How to Implement It in 2026

The 3-2-1 backup rule is a proven data protection framework. Learn what it means, why it still works against ransomware and disasters, and how to implement it step-by-step with specific tools and a real cost example for your small business.

16 min read

Business Tech Tax Guide: Filing 2025 & Planning 2026

Filing 2025 taxes or planning 2026 purchases? Compare Section 179 limits ($2.5M vs $2.56M), bonus depreciation rules, and new R&D expensing opportunities.

27 min read