Xero Accounting Software Review 2024: Pros, Cons, and Verdict

Last Updated on March 25, 2024

Anyone in the small business world will tell you that Xero is a big name in accounting software. It's known for being easy to use, packing in great features, and scaling alongside growing businesses. But with technology always evolving, what does Xero look like in 2024? Does it still hold up for businesses seeking a modern accounting solution?

In this review, we'll look at Xero's current strengths, what's new, and whether it's the right choice for your business needs.

Table of Contents

- 1 Xero Accounting at a Glance: What's New?

- 2 How Xero Stands Out in 2024

- 3 What Our Clients Are Saying About Xero

- 4 In-Depth Look at Xero Features

- 5 The Ease of Using Xero

- 6 Setup and Implementation: Getting Started with Xero

- 7 Xero's Pricing Plans: A Detailed Overview

- 8 Xero vs. Competitors: Comparing the Value for Money

- 9 Xero for Different Business Sizes

- 10 Why Xero is Ideal for Growing Businesses

- 11 Customer Service and Support

- 12 The Pros and Cons of Choosing Xero

- 13 Methodology Behind Our Review

- 14 How We Rated Xero's Features and Services

- 15 Conclusion

- 16 Xero FAQ: Everything You Need to Know

Xero Accounting at a Glance: What's New?

Xero has always aimed to simplify accounting, and in 2024, it continues to focus on refinement and intelligent automation. Here are some of the key areas where Xero has gotten even better:

- AI-Powered Automation: Xero has significantly boosted its use of artificial intelligence (AI). This means more accurate receipt scanning, faster transaction categorization, and smarter suggestions during bank reconciliation.

- Enhanced Reports: Expect dashboards to be more interactive, with the ability to drill down into specific figures and customize visualizations for the insights that matter most to you.

- Focus on Tax Time: If tax prep gives you headaches, Xero might have some relief. We're seeing expanded tax features in 2024 with Xero, potentially streamlining calculations and reporting processes for businesses dealing in multiple currencies and enhancing the accounting process.

- Mobile + Cloud Improvements: Xero's mobile app is getting polished. Expect smoother syncing, improved offline access, and perhaps new features aimed at businesses on the go.

How Xero Stands Out in 2024

While there are some exciting updates, the core reasons to choose Xero remain strong:

- Ease of Use: User-friendly design has always been a Xero hallmark, making it a great option for non-professional accountants.

- Scalability: Whether you are a solopreneur or a growing enterprise, Xero offers plans and features to match your growth trajectory.

- The Power of the Cloud: Access your financials from anywhere, collaborate with your accountant in real-time, and forget about software updates or backups – that's all handled for you.

What Our Clients Are Saying About Xero

We've helped many clients implement and utilize Xero. Here are some of their key experiences and feedback:

Positive Aspects:

- Ease of Use: Clients find Xero's interface user-friendly, especially with its focus on accounting functionality and a clear audit trail.

- Customization: The ability to customize the Xero dashboard is appreciated as it puts the most important information at their fingertips.

- Approval System: The built-in approval workflow streamlines the processes between businesses and their accountants.

- Fixed Asset Register: For businesses managing fixed assets, this is a valuable feature that QuickBooks doesn't offer.

- Analytical Approach: Clients appreciate the analytical tools and reports Xero provides for better business insights.

- Payment Integrations: The flexibility to integrate various payment methods makes transactions easier for clients.

Challenges:

- Learning Curve: Some clients without accounting experience might need more time to familiarize themselves with Xero's terminology.

- Cost: Xero can be a bit more expensive than alternatives.

- Missing Features: The lack of built-in receipt capture, an increasingly standard feature in accounting software, can be a drawback. (you need a 3rd party app Hubdoc for this)

- Interface Design: Some find the design less visually engaging than its competitors.

Overall Impression:

Our clients see Xero as a reliable option that effectively manages their accounting needs. However, some feel it might not be the most intuitive option for those entirely new to accounting or seeking a visually-driven experience.

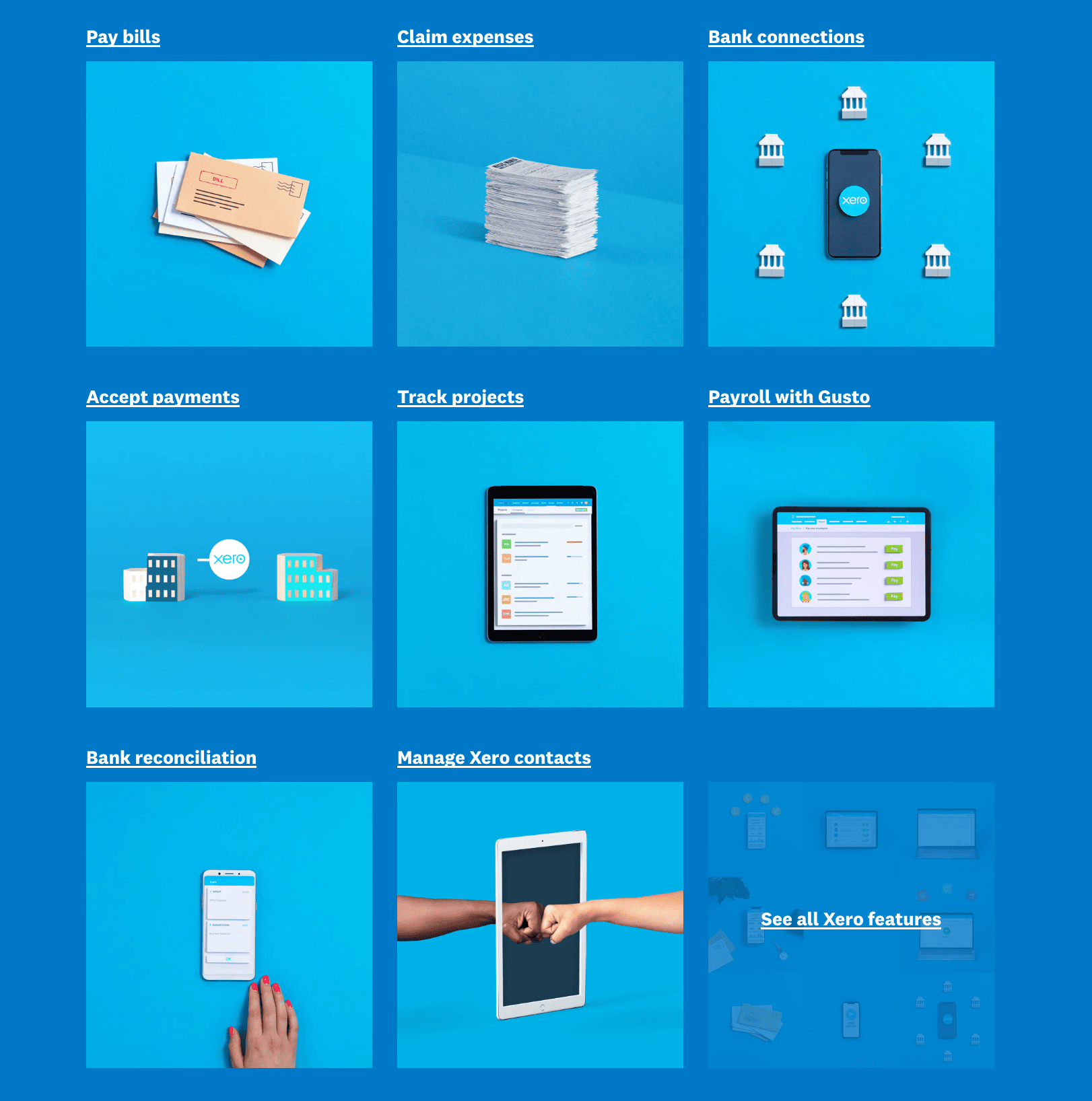

In-Depth Look at Xero Features

This section will focus on two key areas that impact most businesses. We can always expand later if you want to cover more!

Expense Tracking and Bill Pay: Simplified

- Smart Receipt Capture: Get bills and receipts into Xero with Hubdoc. Snap photos of receipts and let Xero's AI extract the important details, saving you time and minimizing data entry errors.

- Bill Management: Keep track of due dates, attach bills directly in Xero, and see what's paid and outstanding with a glance.

- Seamless Payments: Xero integrates with popular payment providers like Stripe, allowing you to accept online payments through your invoices.

Comprehensive Financial Reporting and Data Analytics

- The Dashboard: Your Command Center: Get a real-time snapshot of your business finances, an essential feature of Xero’s online accounting platform. Track key performance indicators (KPIs) tailored to your industry.

- Customizable Reports: Go beyond basic profit and loss. Xero lets you get granular with reports on cash flow, tax summaries, budgets, and more.

- Actionable Insights: Xero's reporting tools aim to help you spot trends, identify areas for improvement, and make informed decisions.

The Ease of Using Xero

Whether you're an accounting whizz or a beginner, Xero makes it easy to take control of your finances. Here's why:

- Intuitive Design: Xero's dashboard and menus are laid out logically, making it a user-friendly accounting tool. Finding what you need doesn't feel like hunting through a complicated software suite.

- Helpful Terminology: Xero avoids overly technical accounting jargon, making it more approachable for non-accountants.

- Mobile App That's Actually Useful: Xero's mobile app isn't just a watered-down version of the web experience. You can snap receipts, reconcile accounts, and check important numbers on the go.

Setup and Implementation: Getting Started with Xero

- Guided Onboarding: Xero walks you through the initial setup, making sure your business info and chart of accounts are set up correctly.

- Import Your Data: Xero helps you easily transfer your existing financial records if you switch from another software.

- Support Resources: It offers a vast library of help articles, videos, and a supportive user community to answer any questions.

READ OUR QUICK-START GUIDE HERE: Xero Accounting 2024: Your Quick-Start Guide

Xero's Pricing Plans: A Detailed Overview

Xero's pricing is transparent and based on a tiered subscription model. As of 2024, they offer the following plans:

- Early: The entry-level plan is designed for sole traders and new businesses. Includes core features like invoicing, bill pay, bank reconciliation, and expense capture.

- Growing: As your business scales, this plan unlocks unlimited invoicing and bills and more robust expense management tools.

- Established: The most comprehensive plan offers features like project tracking, multicurrency support, and advanced expense claim capabilities (useful if you have employees submitting business expenses).

Here's a quick comparison table:

| Features | Early | Growing | Established |

|---|---|---|---|

| Promo Price per Month (First 3 Month) | $3.75 | $10.50 | $19.50 |

| Regular Price per Month | $15 | $42 | $78 |

| Send invoices and quotes | Send quotes and 20 invoices | ✓ | ✓ |

| Enter bills | Enter 5 bills | ✓ | ✓ |

| Reconcile bank transactions | ✓ | ✓ | ✓ |

| Capture bills and receipts with Hubdoc. | ✓ | ✓ | ✓ |

| Short-term cash flow and business snapshot | ✓ | ✓ | ✓ |

| W-9 + 1099 Management | ✓ | ✓ | ✓ |

| Sales Tax | ✓ | ✓ | ✓ |

| Bulk reconcile transactions | × | ✓ | ✓ |

| Use multiple currencies | × | × | ✓ |

| Track projects | × | × | ✓ |

| Claim expenses | × | × | ✓ |

| Analytics Plus | × | × | ✓ |

| Payroll with Gusto | Optional | Optional | Optional |

Beyond the Base Subscription

- Payroll: You can add payroll features to any Xero plan through its integration with Gusto, a popular payroll solution. Payroll costs are additional.

- Xero Analytics Plus: This add-on provides more in-depth reporting and forecasting tools for businesses that need data-heavy insights.

Factors to Consider When Choosing a Plan

- Number of Transactions: A higher-tier plan might be more suitable if you expect to send lots of invoices or have high volumes of bills.

- Specific Features: Do you need project tracking, multicurrency, or expense claims? Ensure the plan you choose offers the tools you need.

- Your Business Size and Growth Trajectory: Xero supports businesses at every stage with its cloud-based accounting software. Don't overpay for features you don't currently use. Xero makes it easy to upgrade later as needed.

Xero vs. Competitors: Comparing the Value for Money

Xero's main rivals, like QuickBooks Online, Zoho Books, and Wave Accounting, offer similar tiered pricing structures. However, Xero often stands out in its balance of features, usability, and scalability within each pricing tier.

Here's a breakdown of how Xero stacks up against QuickBooks Online, Zoho Books, and Wave Accounting:

Xero vs. QuickBooks Online

- Ease of Use: Xero typically wins praise for its intuitive design, making it a strong pick for non-accountants. QuickBooks Online, while powerful, can have a steeper learning curve for beginners.

- Focus: Historically, QuickBooks targets businesses with in-house accounting teams, while Xero appeals to tech-savvy small businesses. This distinction is blurring, but the “ease of use” edge remains with Xero.

- Pricing: Plans are similarly structured, but Xero often includes more features within comparable tiers.

Xero vs. Zoho Books

- Features: Zoho Books boasts a wide array of features, sometimes going beyond even Xero's top tier. However, this can add complexity for those who do not need that level of depth.

- Pricing: Zoho's entry-level plans are very affordable. Xero often becomes more cost-effective as your needs expand into project tracking or advanced reporting.

- Ecosystem: Xero integrates with more popular business apps compared to Zoho in many cases.

Xero vs. Wave Accounting

- Cost: Wave's major differentiating factor is its free plan. For the absolute basics, it's a compelling option. However, feature limitations become apparent quickly as businesses grow.

- Target Market: Wave caters to extremely budget-conscious solopreneurs and micro-businesses. Xero can scale better as the business expands.

- Support: Wave relies heavily on online resources. While also focused on self-service, Xero offers more direct support options, although this can vary by region.

Important: These are general comparisons. The “best” choice depends on your specific business size, accounting experience, the exact features you need, and budget. It's wise to try the free trials offered by each software before committing.

Xero for Different Business Sizes

Xero caters to a broad range of businesses, which is one of its greatest strengths. Here's a breakdown:

- Solopreneurs and Freelancers: If you’re a one-person operation, Xero's “Early” plan gives you the essentials to manage your income, expenses, invoicing, and basic reporting, all without breaking the bank.

- Small Businesses: The “Growing” plan is where Xero shines for most small businesses. It unlocks unlimited invoicing and powerful expense tools and helps you stay organized as your business starts to scale.

- Established Businesses: Larger companies may find the “Established” plan valuable. Its project tracking, multi-currency support, and advanced expense claims streamline operations for teams with more complex financial needs.

Why Xero is Ideal for Growing Businesses

Xero isn't just about handling the present; it helps you plan for the future. Here's why it's particularly strong for growth-minded companies:

- Scalability: You can seamlessly upgrade plans as your transaction volume, feature needs, or team grows. Xero won't hold you back.

- Ecosystem of Integrations: Xero connects with hundreds of popular business tools, including CRM systems, e-commerce platforms, and more. This means your accounting data flows alongside the rest of your operations.

- Focus on Automation: As you take on more clients or business increases, Xero's AI-powered tools save valuable time by automating tedious accounting tasks.

Customer Service and Support

Xero's approach to customer support focuses on online resources and self-service tools. Here's what you need to know:

Xero Central – The Hub of Knowledge

This is Xero's extensive knowledge base, packed with articles, guides, and tutorials for almost any scenario.

Community Forum

Engage with other Xero users and power users, get questions answered, and share knowledge. You'll often find helpful tips and discussions here.

Email Support

You can submit support requests through email and expect a response, although turnaround times can vary depending on complexity and the time of year.

Limited Phone Support

While Xero offers limited phone support options in some regions, it's not always guaranteed. This can be a downside for some who prefer direct contact.

Pros and Cons of Xero's Support

Pros:

- The knowledge base and community are valuable, empowering you to solve common issues yourself. This is ideal for DIY-minded business owners.

Cons:

- No direct phone support can be frustrating during urgent problems. Some businesses prefer the personal touch of talking to a representative quickly.

Alternatives for Hands-on Support

- Xero Partners: Certified Xero accountants and bookkeepers often offer setup assistance, training, and ongoing support.

- Third-Party Consultants: Experts specializing in Xero implementation and troubleshooting who offer tailored assistance.

The Pros and Cons of Choosing Xero

Key Advantages of Using Xero in 2024

- User-friendliness: Xero makes accounting less scary, even if you don't have a financial background.

- Scalability: Easily grow with Xero as your business demands more features and transaction volume.

- Automation Features: Smart tools save time on repetitive tasks, giving you back focus for your business.

- Rich Ecosystem: Integrations extend Xero's functionality and make your accounting data flow smoothly across other business systems.

- Strong Reporting: Gain actionable insights into your financial health.

Drawbacks to Consider Before Making a Decision

- Limited Phone Support: This could be a challenge if you need urgent help or prefer speaking to a representative.

- Pricing Increases: like many software companies, Xero periodically adjusts its subscription costs.

- Potential Complexity: While Xero focuses on ease of use, some find the sheer number of features overwhelming if they only need accounting basics.

Important Note: It's wise to take advantage of Xero's free trial to get a hands-on feel before fully committing.

Methodology Behind Our Review

Transparency is key when evaluating any software. Here's how we approached our Xero review in 2024:

- Hands-on Testing: We actively used Xero across various plan levels to get a true feel for the interface, features, and workflow.

- Third-Party Research: Reputable software review sites, industry reports, and user forums provided insights on Xero's strengths, weaknesses, and updates from various perspectives.

- Competitor Comparisons: We carefully examined current offerings from QuickBooks Online, Zoho Books, and other alternatives, considering 2024 feature sets, pricing, and target audience.

- Focus on the User Experience: We assessed what Xero offers and how easy it is for the average business owner or accountant to utilize those features effectively.

How We Rated Xero's Features and Services

We considered several factors in our evaluation:

- Functionality: Does the feature work as intended, and does it meet the needs of various business types?

- Ease of Use: Can someone without an accounting degree quickly master the feature?

- Value for Cost: Is the feature worth the price point, considering what competitors offer in a similar price range?

- Innovation: Does Xero push boundaries with unique or significantly improved features in 2024?

Conclusion

There you have it! We hope this review has been helpful in understanding how Xero compares to some of its leading competitors.

Choosing the right accounting software is a crucial decision, as it's a tool you'll likely rely on for a significant period. The good news is that many excellent options are available in today's market.

To make the best choice for your needs, we recommend taking advantage of the free 30-day trials many accounting software providers offer. Spend a few days exploring the features and interface to see if it feels like a good fit for your workflow. It can also be beneficial to involve your accountant or bookkeeper in the selection process, as their expertise can be invaluable.

Remember, the best accounting software empowers you to manage your finances efficiently and effectively.

Xero FAQ: Everything You Need to Know

Do I need an accountant or bookkeeper to use Xero?

Not necessarily! Xero's user-friendly design makes it accessible for business owners who want to handle their bookkeeping. However, for complex tax scenarios, ongoing strategic advice, or if you simply want to offload accounting, a certified Xero accountant or bookkeeper can be invaluable.

What web browsers are compatible with Xero?

Xero works best on modern browsers like Chrome, Firefox, Safari, and Edge. Using the latest versions for optimal performance and security is always best. A full list of supported browsers is on Xero's website.

Can Xero be integrated with other software?

Absolutely! Xero has a large and ever-growing app marketplace. Popular integrations include CRM systems (Salesforce, HubSpot), payment processors (Stripe, PayPal), e-commerce platforms (Shopify, WooCommerce), time tracking tools (Harvest), and many more!

Is Xero easy to learn for beginners?

Yes, Xero's intuitive design and helpful resources make it one of the most beginner-friendly accounting options. However, as with any software, there's a learning curve. Don't hesitate to utilize Xero's guides and community forums, or seek help from a Xero partner.

Can I switch from another accounting software to Xero?

Yes, the process can be quite simple! Xero provides tools to import data from common software like QuickBooks Online. For more complex setups, it might be wise to consult with a Xero-certified accountant to ensure a smooth transition.

Is Xero considered the "best accounting software" in 2024?

“Best” is subjective and depends on your specific business needs. However, Xero consistently ranks among the top contenders for its ease of use, scalability, and robust features. It's a fantastic option for many small businesses and those seeking a more streamlined accounting experience.

Does Xero offer a free trial?

Yes, Xero lets you try their software with a free trial period, giving you a chance to experience it before committing to a subscription.

Are there hidden fees with Xero?

Xero's pricing is transparent. Your monthly subscription covers the core software. Additional costs mainly arise from optional add-ons, like payroll or advanced analytics, which are clearly outlined.

Leave a Reply

Want to join the discussion?Feel free to contribute!