QuickBooks Online Tutorial for Beginners: Master QBO in 2024

Last Updated on March 26, 2024

Table of Contents

- 1 QuickBooks Online for Beginners: A Step-by-Step Guide

- 2 Setting Up QuickBooks Online

- 3 Categorizing Transactions

- 4 Creating and Sending Invoices

- 5 Managing Bills and Paying Vendors

- 6 Understanding Sales Tax

- 7 Leveraging QuickBooks Reports

- 8 QuickBooks Online Tips and Best Practices

- 9 Conclusion

- 10 FAQ: Mastering QuickBooks Online 2024

QuickBooks Online for Beginners: A Step-by-Step Guide

Managing your small business finances can feel overwhelming. Between tracking income and expenses, sending invoices, paying bills, and understanding taxes, it's easy to feel lost in a sea of numbers. The good news is you don't have to tackle these tasks alone! Accounting software like QuickBooks Online (QBO) is designed to streamline your financial management, giving you valuable insights into your business health.

If you're a small business owner looking to get a grip on your finances, QBO is an excellent solution. In this beginner's guide, we'll break down everything you need to know about setting up QuickBooks Online and using it to manage your business finances like a pro.

Setting Up QuickBooks Online

Let's start by getting your QuickBooks Online account up and running.

Choosing the Right Plan

QuickBooks Online offers several plans tailored to different business needs. If you're just starting out, Simple Start is a great entry point with core features like income/expense tracking, invoicing, and reporting. As your business grows, you may consider upgrading to Essentials or Plus for additional features like inventory management and employee time-tracking. Check out the QuickBooks website to compare plans and find the best fit.

| Plan | Price/Month (First 3 Months) | Regular Price/Month | Users | Features |

|---|---|---|---|---|

| Simple Start | $15 | $30 | 1 | Basic features for business finance management |

| Essentials | $30 | $60 | 3 | Includes bill management |

| Plus | $45 | $90 | 5 | Adds inventory and project profitability tracking |

| Advanced | $100 | $200 | 25 | Advanced reporting, custom permissions, and more |

Add-On: Live Bookkeeping for an extra $50/month.

Please visit the official QuickBooks pricing page for current details and terms.

Account Creation Process

Signing up for QBO is simple. Visit the QuickBooks website and follow these steps:

- Select your desired plan.

- Click “Choose a Plan.” (You can check 30 Day Trial if you just want to test drive)

- Create an Intuit account (or sign in if you already have one).

- Provide your business information and payment details.

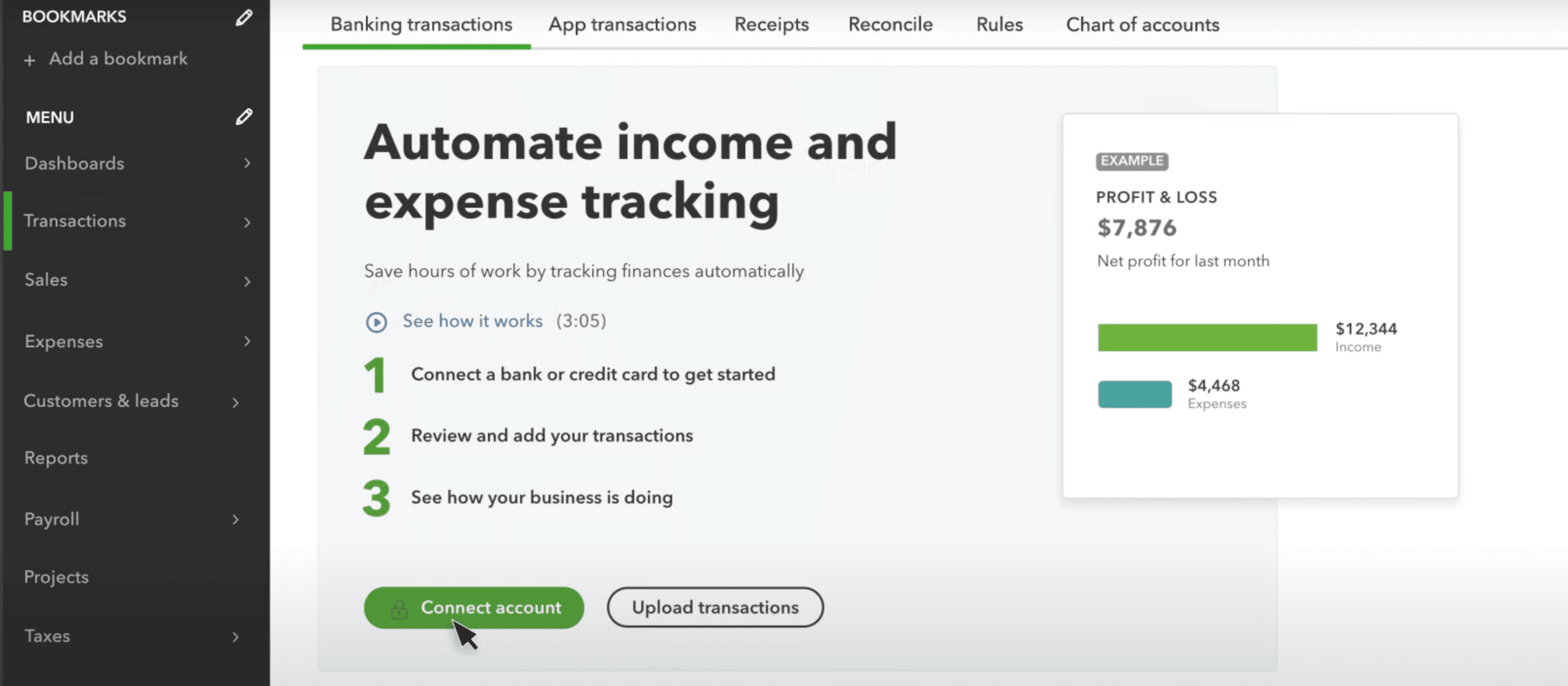

Connecting Bank Accounts and Credit Cards

One of the key benefits of using QBO is the ability to automatically import transactions from your bank accounts and credit cards. Here's how to connect them:

- In your QBO dashboard, navigate to the “Banking” or “Transactions” tab.

- Click “Connect Account” or a similar button.

- Search for your bank or credit card company.

- Follow the prompts to securely enter your online banking credentials.

Once connected, your transactions will flow seamlessly into your account, saving you hours of manual data entry.

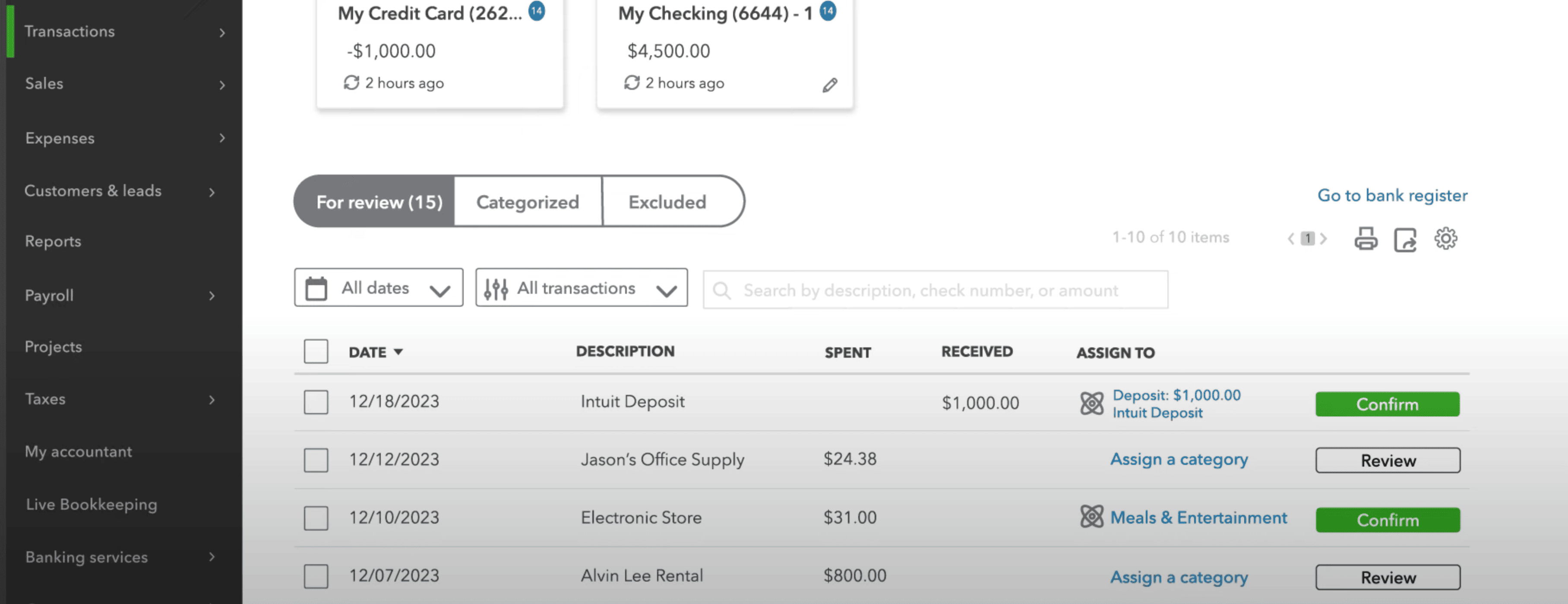

Categorizing Transactions

Now that your bank accounts are linked, it's time to start making sense of those imported transactions. Proper categorization is the foundation of accurate bookkeeping, so let's break it down.

Importance of Accurate Categorization

When you categorize transactions (like customer payments, purchases, utility bills, etc.), you tell QBO what kind of income or expense it is. This has several benefits:

- Budgeting: Tracking specific types of expenses helps you set realistic budgets and spot areas for cost-cutting.

- Financial Reporting: Accurate categorization generates clear profit & loss statements, balance sheets, and other essential insights into your business health.

- Tax Prep: When tax time comes, well-categorized transactions make filing your tax returns significantly easier.

Creating and Customizing Categories

QBO comes with a standard list of categories, but every business is a little different. Talk to your accountant to make sure you have the right categories for your specific needs. To manage categories in QBO:

- Navigate to “Settings” (the gear icon).

- Select “Categories.”

Here, you can add, edit, or delete categories to match your business.

Tags and Memos

In addition to categories, QBO lets you use tags and memos for extra clarity:

- Tags: Think of these as labels to track things like projects, specific clients, or marketing campaigns.

- Memos: Use this field to add notes about transactions for yourself or your bookkeeper.

Creating Rules for Automation

Save yourself tons of time by setting up rules for recurring transactions. Here's how:

- In your “Banking” or “Transactions” tab, find a recurring transaction (e.g., monthly internet bill).

- Click “Create Rule” and give it a descriptive name.

- Set conditions that match your transaction (e.g., “Description contains ‘Web Hosting XZY').

- Tell QBO what to do – assign a category, vendor, memo, tag, etc.

- Choose if you want the rule to auto-apply to future transactions.

With well-defined rules, QBO does the categorization work for you!

Creating and Sending Invoices

One of the core functions of QBO is creating professional invoices to bill your clients. Here's how the process works:

Step-by-Step Invoice Creation

- In the QBO navigation, go to “Sales” or the “+” symbol and select “Invoice.”

- Select the customer from your existing list or click “Add New” to enter their details.

- Add line items for the products or services you provided:

- Choose from existing items in your inventory or create new ones on the fly.

- Enter the quantity and price for each item.

QBO automatically calculates totals and applies sales tax if you've set it up.

Customizing Invoices

Make your invoices reflect your brand for a professional touch:

- In “Settings,” you'll find an invoice customization area.

- Add your company logo, adjust colors, and choose a template that suits your style.

Payment Options

Streamline the process for your clients by offering flexible payment methods! QBO integrates with several payment gateways. You'll need to set these up separately to accept online payments like credit cards or direct bank transfers. Check out this article from Intuit to learn about payment options.

Sending Invoices

Once your invoice is perfect, hit the “Save and Send” button. QBO gives you the option to email it directly to your client and even track when they've opened it.

Pro Tip: QBO can help you track overdue invoices and send automatic reminders to clients, saving you the awkwardness of chasing payments.

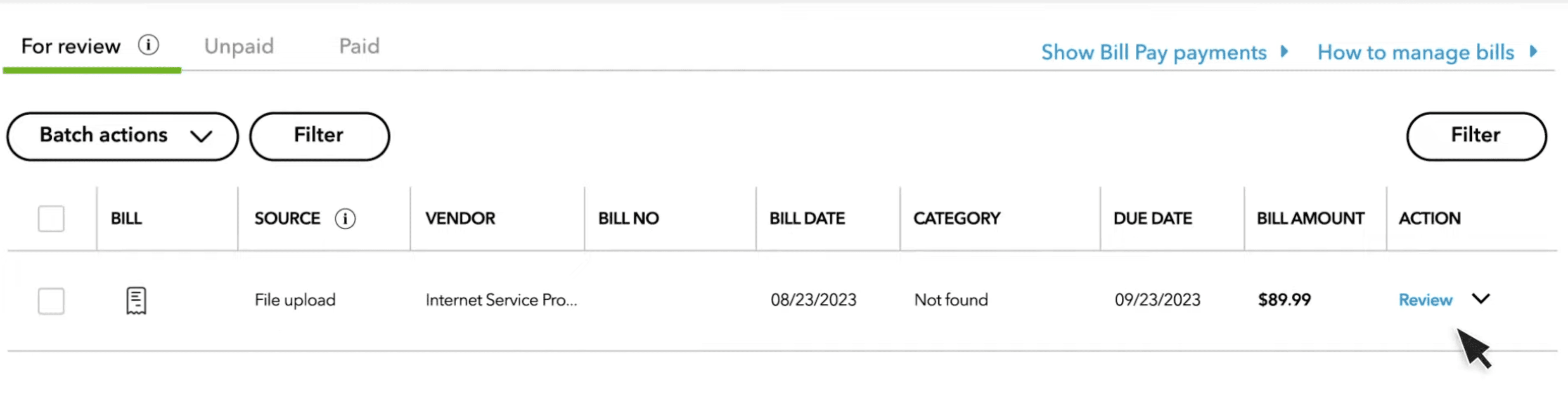

Managing Bills and Paying Vendors

Just like getting paid on time is important, so is paying your suppliers and vendors to maintain good relationships and keep your business running smoothly. Here's how QBO helps you stay on top of your bills:

Adding Bills

There are a couple of ways to add bills to QuickBooks Online:

Manual Entry

- Go to “Expenses” or “+” and select “Bill.”

- Fill out the vendor details, bill amount, due date, and relevant categories.

Upload Invoices

If your vendor sends you a PDF invoice, you can save time by uploading it directly to QBO. QBO scans the invoice and fills in the details automatically (always double-check to be sure!).

Scheduling and Paying Bills

Once your bills are in QBO, paying them is simple:

- Navigate to the “Bills” or “Pay Bills” section.

- Select the bills you want to pay.

- Choose your payment method – QBO offers direct bank transfers and the option to send checks. You'll need to set up your preferred method in your QBO settings.

Tips for Staying Organized

- Utilize due dates: Set alerts for upcoming bills to avoid late payments.

- Consider early payment discounts: If your vendors offer them, you can save money!

- Batch payments: Save time by paying multiple bills at once when possible.

QuickBooks Online Bill Pay: For an additional fee, QBO offers a Bill Pay service, further streamlining the process. You can authorize QBO to pay your bills on your behalf, saving you even more time and hassle. You can learn more about Bill Pay on the QuickBooks website.

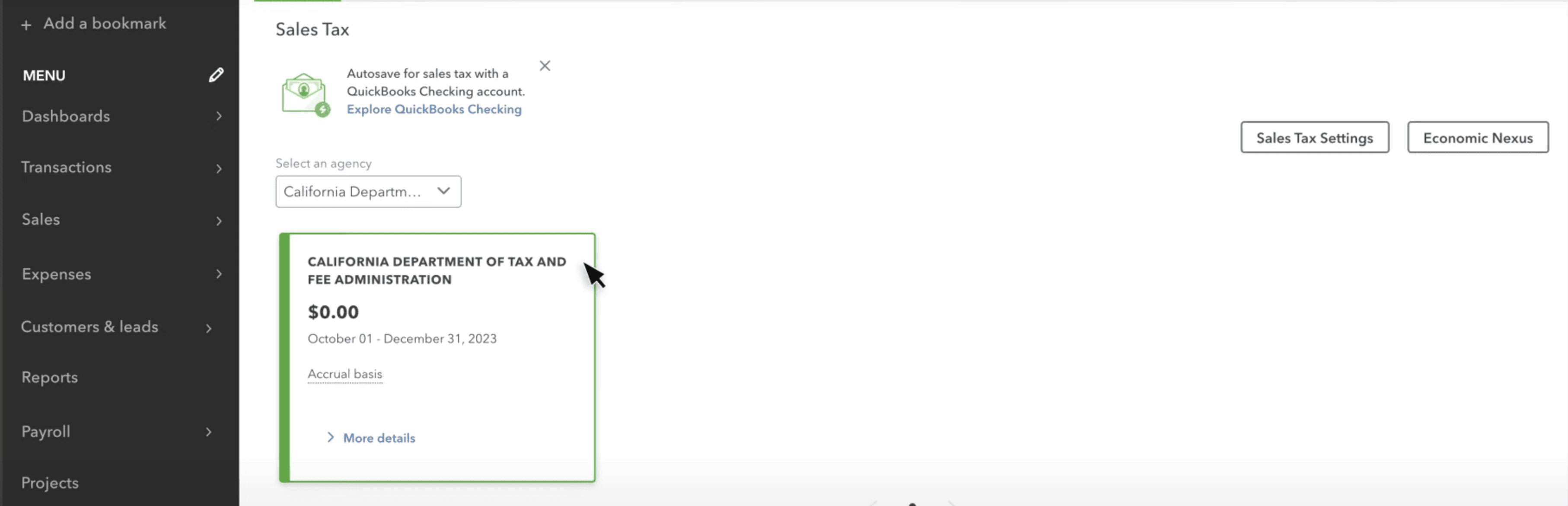

Understanding Sales Tax

Sales tax is a reality for many small businesses. Luckily, QBO has tools to help you calculate, track, and file sales tax returns with less headache.

How QBO Automates Sales Tax

- When you set up QBO, it prompts you to enter your business location(s) to identify the relevant tax agencies.

- As you create invoices, it automatically calculates sales tax based on the customer's location and the applicable tax rates you've configured.

- QBO keeps a running tally of how much sales tax you owe to each tax agency.

Compliance and Tax Filing

QB lets you view and file sales tax returns directly within the software. Some versions even offer automated filing services for select areas. Having accurate sales tax records in QBO is invaluable come tax time – whether you file yourself or work with an accountant.

Important Notes:

Sales tax rules can be complex and vary by jurisdiction. It's always wise to consult an accountant to ensure you're setting up QBO's sales tax features correctly for your specific business. QBO's sales tax features generally require a paid subscription beyond the basic plan.

Leveraging QuickBooks Reports

Quicjkbooks provides a suite of reports to give you different perspectives on your business finances. Here's a breakdown of the key reports and how to use them:

Profit and Loss (P&L)

- The P&L is your financial scorecard, showing how much money you made (revenue) and spent (expenses) over a specific period of time (e.g., monthly, quarterly, annually).

- Use the P&L to track your profitability over time, identify areas where you might be able to cut costs and monitor revenue growth, and spot trends.

Balance Sheet

- The Balance Sheet gives you a snapshot of your business's financial health at a particular moment. It summarizes your assets (what you own), liabilities (what you owe), and equity (your ownership stake in the business).

- Use the Balance Sheet to assess your overall financial strength and stability and understand your company's net worth.

Sales Reports (Sales by Customer, Sales by Product/Service)

- These reports drill down into your sales data, revealing valuable insights, such as who your top-paying customers are and which products or services are most popular and profitable.

- Use sales reports to target your marketing efforts towards your most lucrative customers and products and make informed decisions about inventory and pricing.

Expenses Reports (Expenses by Vendor)

- Get granular insights into where your money is going with vendor-specific reports.

- Use Expense reports to negotiate better contracts with suppliers or vendors and identify areas where you might be overspending.

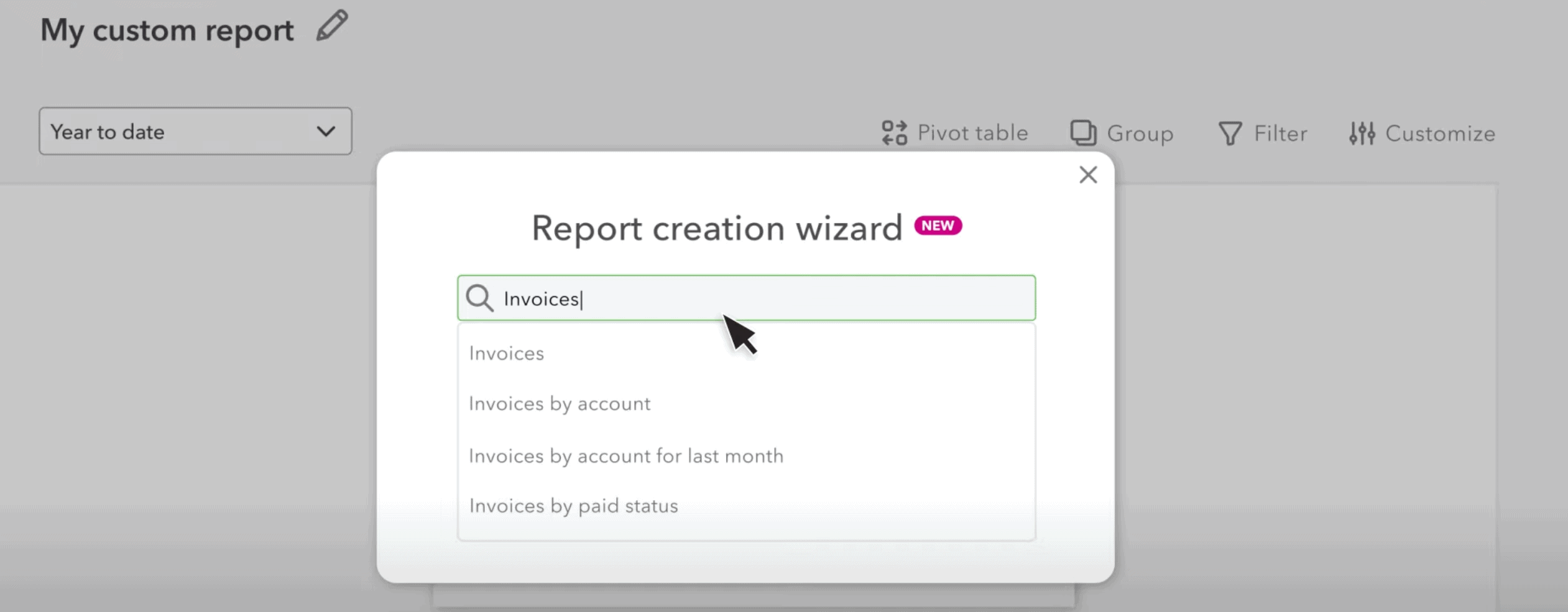

Customization and Filtering

The most powerful aspect of QBO's reports is their customizability. You can:

- Change date ranges: Compare the current year vs. the previous year, specific months, or custom ranges.

- Apply Filters: Drill down to see reports on specific customers, products, categories, etc.

QuickBooks Online Tips and Best Practices

Here are some handy tips to enhance your QBO experience:

- Reconcile Regularly: Reconciling your QBO accounts with your bank statements ensures your bookkeeping is accurate and up-to-date. Aim to do this at least monthly.

- Utilize the Mobile App: QBO's app keeps your finances at your fingertips. Use it to send invoices, snap photos of receipts, and check your balances even when you're away from your desk.

- Take Advantage of QBO Resources: QuickBooks offers excellent support in various forms:

- Help Center: Find answers to common questions within the QBO dashboard.

- Blog: Get tips and updates on the QuickBooks blog.

- Community Forums: Connect with other users and experts.

- YouTube Videos: There are many step-by-step YouTube videos on how to use Quickbooks.

- Consider a QuickBooks ProAdvisor: If you need more in-depth help, these certified experts can provide setup assistance, training, and ongoing guidance.

Conclusion

Mastering the fundamentals of QuickBooks Online sets your small business up for long-term financial success. QBO allows you to streamline your accounting, make better business decisions, and save valuable time.

Don't be afraid to experiment with QBO's features as your confidence grows. Just get started with Quickbooks; the more you use the software, the more intuitive it will become and the more benefits you'll unlock for your business!

FAQ: Mastering QuickBooks Online 2024

Is QuickBooks Online the right fit for my business in 2024?

Absolutely! QBO offers cloud access to manage your finances anywhere, powerful automation to save time, and seamless integrations with other essential business tools. Plus, QuickBooks is always rolling out new features in 2024!

Im completely new to QuickBooks Online. How do I get started?

Don't worry, it's easy! In addition to this article, there are many video tutorials on the Intuit website to get you started.

The QuickBooks dashboard looks a little overwhelming – can you break it down for me?

Of course! Think of it as your financial command center. You have sections for Sales (invoices, customers), Expenses (bills, vendors), Banking (connected accounts), Reports (insights on your business), and more.

How do I create and send invoices in QuickBooks Online?

Invoicing is a breeze with QB. Here's a quick guide [link to invoice tutorial] to get you started.

Connecting my bank seems smart, but how do I categorize all those transactions?

Connecting your accounts is a huge time-saver! QBO helps you categorize (e.g., office supplies and rent) for accurate budgeting and tax reporting.

Can QuickBooks Online help with payroll?

Yes! Depending on your QBO plan, you get integrated payroll features. Here's how to set it up and use it: https://quickbooks.intuit.com/payroll/

I need very specific data. How do I customize QuickBooks Online reports?

QBO reports are your secret weapon! You can filter by date, customer, category, and more. Plus, save your favorite custom reports for quick access later.

Im tired of doing the same tasks over and over. Tell me about QuickBooks Online automation!

Get ready to streamline! QBO lets you set up rules for recurring transactions, automatic payment reminders, and more. Explore different QBO plans to see which automation features are right for you.

Uh oh, Im stuck! How do I troubleshoot and get help with QuickBooks?

Don't panic! Start with the QBO Help Center. If needed, you'll also find a fantastic community forum and an official YouTube channel.

Im using old accounting software. Is it worth switching to QuickBooks Online 2024?

Definitely! QBO's ease of use, cloud features, and new 2024 updates make it a smart upgrade. Plus, migrating your data is usually straightforward.

How do I make the switch to QuickBooks Online as smooth as possible?

Here's a handy video to ensure everything goes well.

I want to become a QuickBooks Online power user! How do I keep learning?

You're in the right place! QBO offers free training, has a fantastic Resource Center, and a supportive user community. For tailored guidance, consider a QuickBooks ProAdvisor.

Ready to dive deeper into choosing the right business software? Check out our comprehensive Small Business Software Guide for insights and comparisons.

Still exploring accounting software options? Our roundup of the Best Accounting Software for Small Business can help you find the perfect fit.

Leave a Reply

Want to join the discussion?Feel free to contribute!