QuickBooks Desktop Alternatives 2026: The Final Migration Guide

Complete guide to QuickBooks Desktop alternatives as Intuit phases out Pro, Premier, and Mac Plus. Compare QuickBooks Online, Xero, and Wave with pricing, features, and migration strategies.

Affiliate Disclosure: This article contains affiliate links. If you make a purchase through these links, we may earn a small commission at no extra cost to you.

Key Takeaway

As Intuit phases out QuickBooks Desktop Pro, Premier, and Mac Plus versions (with Desktop 2024 support ending May 31, 2027), businesses need to evaluate their accounting software options. QuickBooks Online ($20-$275/month) offers the smoothest migration path and maintains familiar workflows. Xero ($25-$90/month) provides strong international features and unlimited users, while Wave offers a permanently free tier for core accounting. The right choice depends on your business size, feature requirements, and budget.

Urgent: Desktop 2023 Users

Using QuickBooks Desktop 2023? Support ends May 31, 2026—just 4 months away. After this date, you'll lose access to online banking, payroll processing, and merchant services. Start planning your migration now to avoid disruption during tax season.

Intuit discontinued new subscriptions for Desktop Pro Plus, Premier Plus, and Mac Plus on September 30, 2024, and existing Desktop versions are losing support on a rolling schedule. Desktop 2024 will stop receiving payroll and payment services on May 31, 2027. QuickBooks Desktop 2022 lost support on May 31, 2025.

This shift requires a decision: migrate to QuickBooks Online, explore alternatives like Xero or Wave, or stick with Desktop Enterprise (starting at $130/month). The right choice depends on your business size, international operations, budget constraints, and technology readiness.

Why Businesses Are Leaving QuickBooks Desktop

The migration away from QuickBooks Desktop isn't entirely voluntary. Intuit has implemented a systematic phase-out strategy that makes Desktop increasingly expensive and less viable for most small businesses.

Desktop subscription costs have increased approximately 400% from 2023 to 2025 for some users. What used to cost $250 every two years now runs $530-$999 annually, with additional per-employee fees for payroll features. A small business with Desktop Pro Plus that paid $689 in 2024 now faces $810-$999 in 2025, with no additional features to justify the increase.

Support Timeline

| Version | Support End Date | Impact |

|---|---|---|

| Desktop 2022 | May 31, 2025 | Already ended |

| Desktop 2023 | May 31, 2026 | Ends in 4 months (Jan 2026) |

| Desktop 2024 | May 31, 2027 | Last supported version |

After these dates, the software continues functioning for basic bookkeeping, but loses online features and technical support.

What You Lose Without Support

- Automatic bank feeds (requiring manual entry)

- Payroll processing (needs separate system)

- Online payments and merchant services

- Security updates and patches

- Technical support

Intuit's strategy is evident: the focus has shifted to QuickBooks Online and QuickBooks Enterprise. The question isn't whether to migrate, but which alternative best serves your specific business needs.

QuickBooks Online: The Official Migration Path

QuickBooks Online represents Intuit's intended destination for Desktop users. The platform offers the smoothest migration process, maintains familiar QuickBooks workflows, and provides the most comprehensive feature set among cloud-based alternatives. However, it also carries the highest price tag and some notable limitations compared to Desktop.

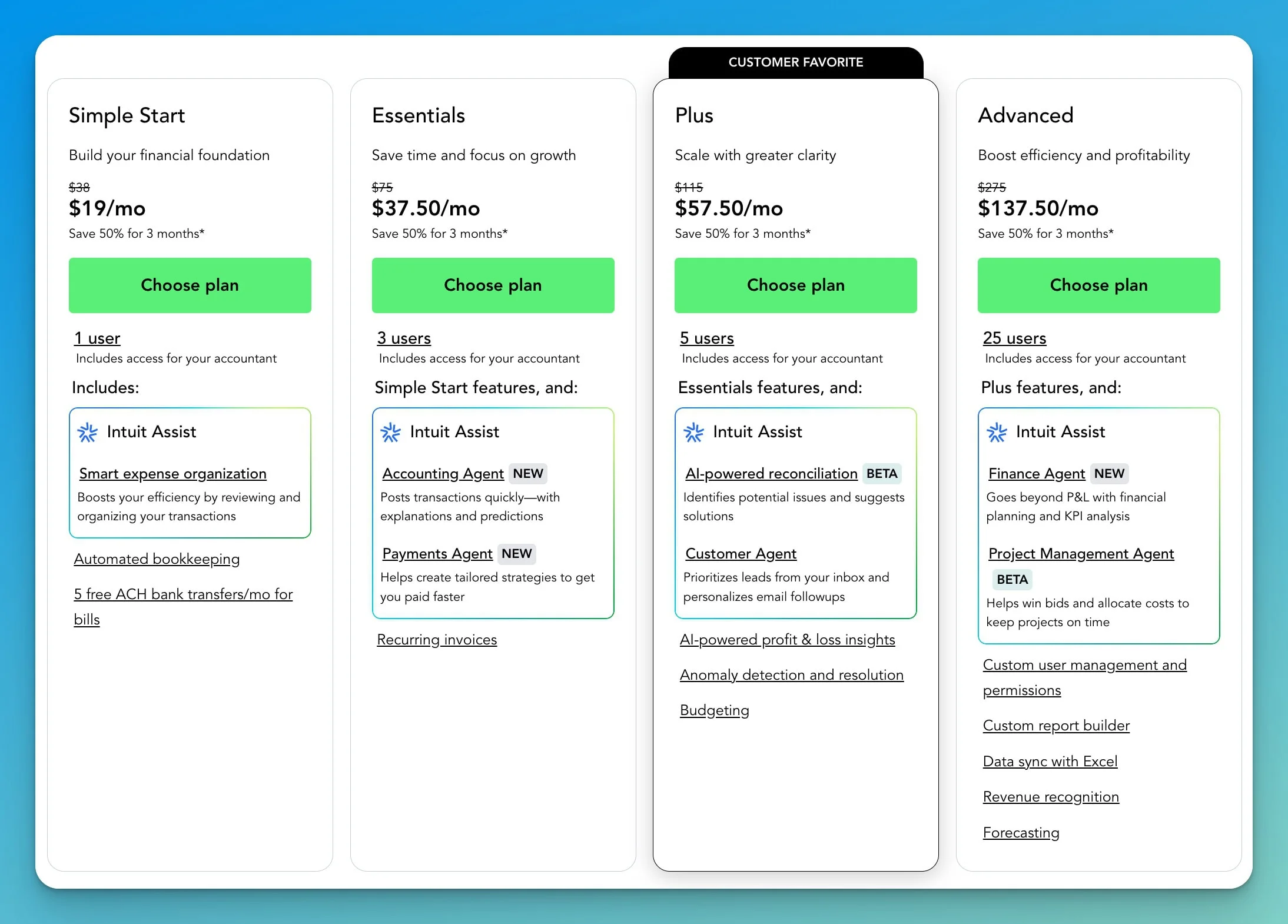

Pricing Structure (January 2026)

QuickBooks Online Plans

Solopreneur: $20/month for 1 user. Income/expense tracking, mileage tracking, quarterly tax estimates, invoicing, receipt capture. Designed for self-employed individuals and freelancers.

Simple Start: $38/month for 1 user. Income/expense tracking, invoicing, receipt capture, tax deductions, basic reports. Best for small businesses without employees.

Essentials: $75/month for 3 users. Adds bill management, time tracking, multi-user access. For businesses with employees needing financial access.

Plus: $115/month for 5 users. Inventory tracking, project profitability, 1099 contractor management. Most popular for growing businesses.

Advanced: $275/month for 25 users. Batch invoicing, custom permissions, advanced reporting, workflow automation. For larger small businesses.

Pricing increases annually, typically in the summer. From 2023 to 2025, plans increased an average of 11.9-17.3% per year—budget for ongoing price growth.

Migration Process

QuickBooks provides a built-in migration tool that transfers Desktop data to Online in approximately 15-30 minutes for most businesses. The process copies your chart of accounts, customers, vendors, items, and historical transactions.

Critical limitation: Files with more than 750,000 targets (combined count of customers, vendors, items, and transactions) cannot be migrated automatically. This affects approximately 5-10% of Desktop users with 10+ years of data or high transaction volumes.

What Works Well

- Automatic bank connections save 15-30 minutes weekly

- Modern cloud benefits: Mobile apps with full functionality, real-time accountant collaboration, and automatic backups

- 650+ third-party integrations far exceed Desktop's capabilities

Notable Limitations

- No traditional sales orders (requires workarounds)

- Only FIFO and average cost inventory methods (no LIFO)

- Less robust job costing than Desktop Premier Contractor edition

- Performance can lag with 50,000+ transactions

- Requires internet connectivity—no offline access

Who Should Choose QuickBooks Online

QuickBooks Online Is Best For

- Businesses already comfortable with QuickBooks workflows and terminology

- Teams needing mobile access and remote collaboration

- Companies with accountants who prefer the QuickBooks ecosystem

- Organizations requiring extensive third-party integrations

- Businesses willing to pay premium pricing for full-featured solutions

QuickBooks Online offers the path of least resistance for Desktop users. The migration process works reliably, the interface feels familiar, and your accountant likely already knows the platform. Pricing ranges from $240-$3,300 annually depending on plan choice.

Try QuickBooks Online with 30-Day Free TrialXero: The International Alternative

Xero positions itself as the QuickBooks alternative for growing businesses and international operations. The New Zealand-based company offers unlimited users on all plans, strong multi-currency support, and a modern interface that non-accountants find approachable.

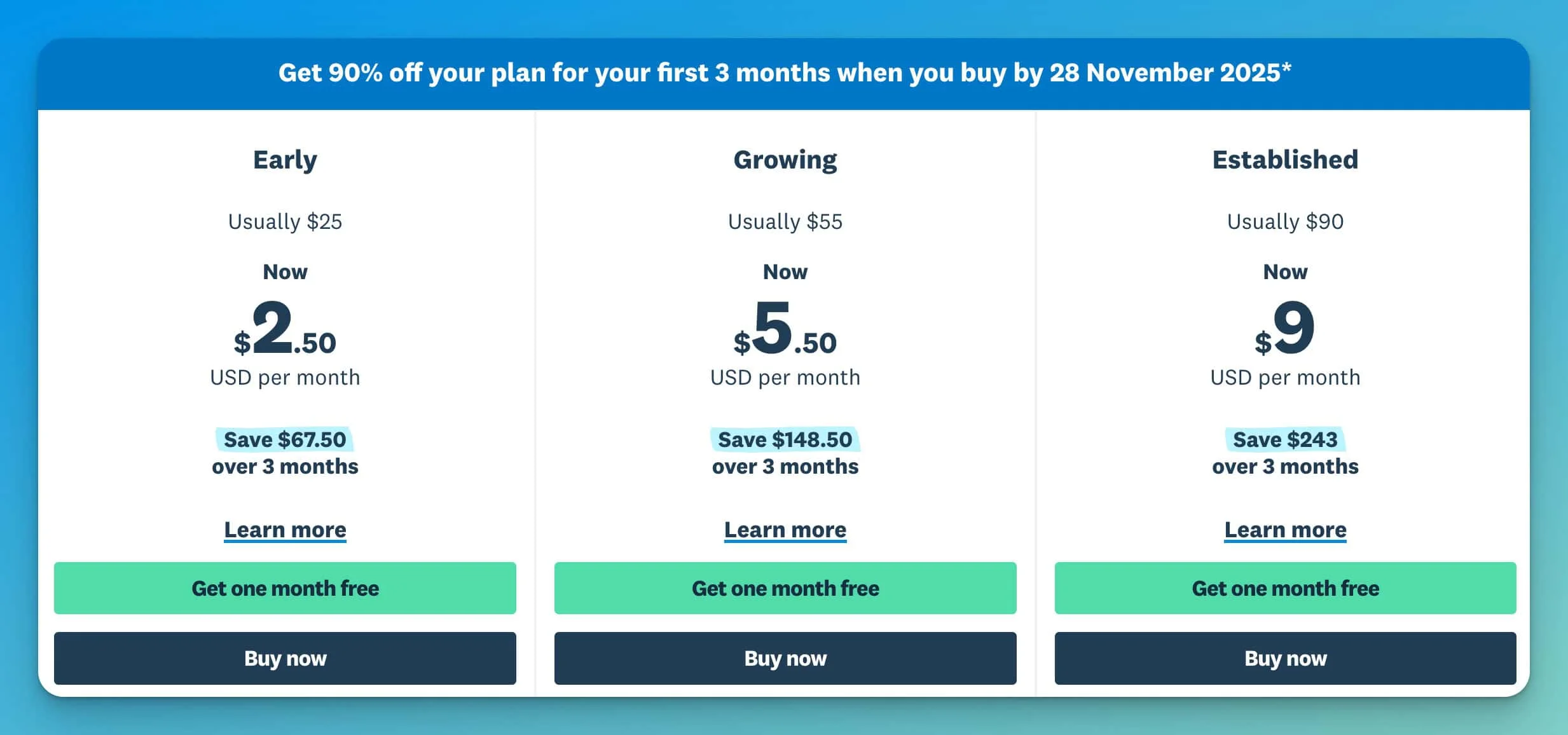

Pricing Structure (January 2026)

Xero Plans (Unlimited Users)

Early: $25/month. 20 invoices/bills monthly, bank reconciliation, expense claims, basic reporting. For new businesses with low transaction volumes.

Growing: $55/month. Unlimited transactions, invoices, bills, batch payments, purchase orders. Most popular for established small businesses.

Established: $90/month. Multi-currency support, advanced reporting, project tracking, expense management. For international operations.

The Unlimited User Advantage

Xero's most compelling feature is unlimited user access across all plans. A business with 10 employees can give everyone appropriate access without additional charges.

Cost comparison for 7 users:

- QuickBooks Advanced (only plan supporting 7+ users): $275/month

- Xero Growing: $55/month

- Annual savings: $2,640 (80% cost reduction)

Multi-Currency Excellence

Xero's multi-currency capabilities exceed QuickBooks in both functionality and accessibility. The Established plan ($90/month) supports:

- Multiple currencies with automatic exchange rate updates

- Multi-currency invoicing and bank accounts

- Automatic foreign exchange gains/losses tracking

QuickBooks Online requires the Advanced plan ($275/month) for equivalent functionality.

Integration Ecosystem

Xero connects to 1,000+ third-party applications. Important for U.S. businesses: Xero does not have native payroll—it relies entirely on third-party integrations like Gusto ($49/month base + $6 per employee). QuickBooks Online includes native payroll options, which can be a significant differentiator for businesses prioritizing integrated payroll.

Migration Considerations

Xero doesn't offer a direct migration tool from QuickBooks Desktop. Moving requires:

- Third-party migration service ($200-$500 typically)

- Or manual data entry with opening balances

Learning curve: Budget 20-40 hours for initial setup and learning. Most users report Xero is more intuitive than QuickBooks once learned.

What Xero Does Better

- Bank reconciliation is faster and more reliable

- Reporting flexibility more accessible to non-accountants

- User interface designed for business owners, not just accountants

- Tracking categories provide granular multi-department reporting

Notable Limitations

- Less robust inventory management than QuickBooks Online Plus

- Project tracking only in Established plan ($90/month)

- Fewer U.S. accountants are familiar with Xero vs QuickBooks

Who Should Choose Xero

Xero Is Best For

- Businesses with international customers, suppliers, or operations

- Growing companies needing multiple users without escalating costs

- Organizations wanting cleaner interface and better user experience

- Businesses willing to invest in migration and training for long-term value

- Companies that don't require advanced inventory features

For a detailed comparison, read our complete QuickBooks vs Xero analysis.

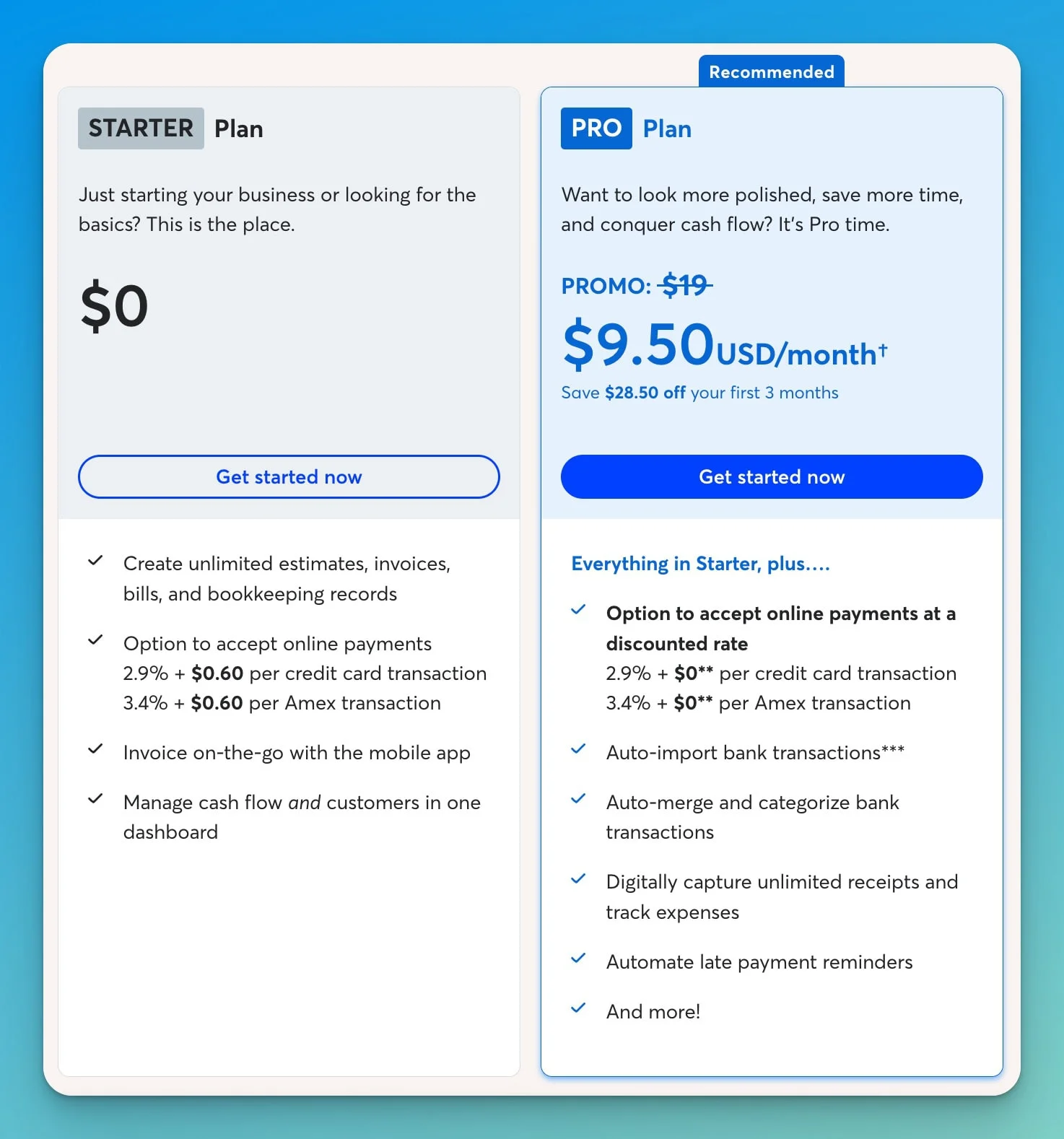

Start a Free 30-Day Trial of XeroWave: The Budget-Conscious Solution

Wave Accounting offers a permanently free tier for core features—unlimited invoicing and bookkeeping at no cost, rather than a time-limited trial. For businesses with annual revenue under $100,000 and straightforward accounting needs, Wave eliminates software costs entirely.

Pricing Structure (January 2026)

Wave Plans

Starter (Free): $0/month with unlimited users. Unlimited invoicing, accounting transactions, expense tracking, financial reports, receipt scanning, bank connections. No credit card required, no time limits.

Pro: $19/month or $190/year. Adds automated bank imports, message templates, advanced user permissions, priority support.

Payroll Add-on: $40/month + $6 per employee (U.S. and Canada only).

Payment Processing: 2.9% + $0.60 per credit card, 1% for ACH bank payments.

What's Actually Free

The free plan isn't limited by transactions, invoices, or users:

- Process 10,000 transactions monthly

- Send 1,000 invoices

- Add 50 team members

- All free—indefinitely

Core features include double-entry accounting, unlimited invoice creation, expense tracking, financial reports (P&L, balance sheet, cash flow), receipt capture, and sales tax tracking.

What's not included free: Automated bank imports (manual entry or CSV upload required), advanced user permissions, priority support.

Who Wave Serves Well

Wave works best for service-based businesses without inventory:

- Freelancers and consultants

- Professional services

- Creative agencies

- Home-based businesses

Revenue threshold: Businesses with annual revenue under $100,000 typically stay within Wave's capabilities. Growing beyond that level often triggers needs Wave doesn't provide.

Integration Limitations

Wave's integration ecosystem is its most significant limitation—approximately 30 applications compared to QuickBooks Online's 650+ or Xero's 1,000+. Available integrations include Shopify, PayPal, Zapier, and Etsy.

Migration Process

Wave doesn't provide an import tool for QuickBooks Desktop data. Migration requires:

- Exporting lists as CSV files from QuickBooks

- Importing manually into Wave

- Starting fresh with opening balances

Setup time is minimal—most businesses complete Wave setup in 2-4 hours.

When to Upgrade to Pro

The $19/month Pro plan adds automated bank feeds, saving approximately 2-4 hours per month in manual transaction entry. For businesses valuing time at $25/hour or more, the automation pays for itself immediately.

Who Should Choose Wave

Wave Is Best For

- Service-based businesses without inventory needs

- Freelancers and solopreneurs with straightforward finances

- Startups and businesses under $100,000 annual revenue

- Organizations needing to eliminate software costs entirely

- Businesses comfortable with limited integrations and basic features

For a detailed analysis, read our complete Wave Accounting review.

Start Using Wave Free AccountingOther Alternatives Worth Considering

QuickBooks Desktop Enterprise

For businesses requiring Desktop software, Enterprise remains available starting at $130/month. Includes:

- Advanced inventory management

- 200+ report templates

- Up to 40 simultaneous users

- Industry-specific editions

Makes sense for complex inventory needs or industry requirements cloud solutions can't address. However, $1,560+ annually is substantial.

Hosted QuickBooks Desktop

For users who prefer to maintain their current Desktop interface while gaining cloud accessibility, hosted QuickBooks Desktop offers a middle ground. Third-party providers like Right Networks, Swizznet, and Summit Hosting run your Desktop software on cloud servers, giving you:

- The exact Desktop interface and functionality you're familiar with

- Remote access from any device via web browser

- Automatic backups and updates

- Multi-user collaboration without file sharing

Pricing: Typically $50-$75/month per user plus the cost of your Desktop license. For a 3-user setup, expect $150-$225/month ($1,800-$2,700 annually).

Best for: Businesses with complex Desktop workflows, industry-specific customizations, or teams that prefer to maintain their current interface. This option preserves your existing setup while adding cloud benefits at a premium cost.

FreshBooks

Targets service-based businesses with emphasis on time tracking and project profitability. $17-$55/month. Excels at invoicing and client communication but lacks robust accounting features compared to QuickBooks or Xero. Learn more in our business software comparison guide.

Zoho Books

Offers a free plan for businesses under $50,000 annual revenue, with paid plans ranging $15-$240/month. Integrates deeply with Zoho's 45+ business applications, making it ideal for businesses already using or planning to adopt multiple Zoho tools.

Sage Business Cloud Accounting

$10-$25/month with unlimited users. Solid basic accounting but lacks the integration ecosystem of QuickBooks or Xero.

Migration Planning and Data Transfer

Data Migration Strategies

Full migration: Transfer all historical transactions. Works well for businesses under 50,000 transactions. QuickBooks Online supports this automatically; Xero and Wave require third-party services ($200-$500).

Opening balance migration: Transfer lists and opening balances while leaving historical transactions in Desktop. This "clean start" approach can simplify your accounting structure.

Parallel operation: Run Desktop alongside new software for 1-3 months. This approach reduces risk but requires double data entry during the transition period.

Timing Your Migration

- Best timing: Fiscal year-end or quarter-end provides clean data boundaries

- Avoid: Peak business periods, tax season, and annual close

- Plan for: Additional time for your first month-end close in the new software

Team Training Requirements

| Platform | Initial Training | Productivity Normalization |

|---|---|---|

| QuickBooks Online | 4-8 hours | 2-3 weeks |

| Xero | 8-12 hours | 4-6 weeks |

| Wave | 2-4 hours | 1-2 weeks |

Common Migration Mistakes

Avoid These Migration Pitfalls

- Rushing migration without adequate planning or team buy-in

- Not testing the new system with sample data before going live

- Failing to document current Desktop workflows before migration

- Underestimating learning curve impact on productivity

- Not involving your accountant in platform selection

- Choosing software based solely on price without considering feature needs

Working with Your Accountant

Involve your accountant early. Many charge less for monthly services if you use their preferred platform. If switching accountants simultaneously, complete the accounting change first before migrating software.

Decision Framework: Choosing Your Alternative

Choose QuickBooks Online If:

- You want the smoothest, fastest migration with minimal disruption

- Your accountant requires QuickBooks for their workflow

- You need extensive third-party integrations (650+ apps)

- Budget allows $240-$3,300/year depending on features needed

- You require robust inventory management and job costing (Plus plan or higher)

Choose Xero If:

- You need multiple users without per-user pricing escalation

- International operations require strong multi-currency support

- You're willing to invest in migration and learning curve for better long-term value

- User experience and interface design matter significantly

- Budget allows $300-$1,080/year for accounting software

- You can work with third-party payroll integration (no native US payroll)

Choose Wave If:

- Eliminating software costs is top priority

- You operate a service-based business without inventory

- Annual revenue is under $100,000

- Basic accounting features meet your needs

- Limited third-party integrations are acceptable

Cost Comparison Over 3 Years

| Platform | Entry Plan | Year 1 | 3-Year Total* |

|---|---|---|---|

| QuickBooks Online | Solopreneur | $240 | ~$790 |

| QuickBooks Online | Simple Start | $456 | ~$1,500 |

| Xero | Growing | $660 | ~$1,980 |

| Wave | Starter (Free) | $0 | $0 |

| Wave | Pro | $190 | $570 |

*Assumes ~10% annual increases for QuickBooks and Xero

Questions to Ask Before Deciding

-

What features do we actually use in Desktop? Many businesses use only 20-30% of capabilities.

-

How many users need access? 5+ users make Xero's unlimited model attractive.

-

What's our accountant's preference? Their platform expertise affects service costs.

-

Do we have international transactions? Multi-currency needs favor Xero.

-

What's our annual software budget? Factor in expected yearly price increases.

Frequently Asked Questions

Can I continue using QuickBooks Desktop indefinitely?

Yes, QuickBooks Desktop will continue functioning for basic bookkeeping after support ends. However, you'll lose access to online banking, payroll, merchant services, and technical support. Security updates also stop, creating data security risks.

Will my accountant work with any accounting software I choose?

Most accountants work with multiple platforms, but many have strong preferences. They may charge less if you use their preferred software. Discuss platform choices before deciding.

How long does migration typically take?

- QuickBooks Online: 15-30 minutes data transfer + 2-4 weeks team adjustment

- Xero: 2-4 days setup + 4-6 weeks adjustment

- Wave: 2-4 hours setup + 1-2 weeks adjustment

What happens to my historical data when I migrate?

QuickBooks Online can import several years of transactions automatically (under 750,000 targets). Xero and Wave typically use opening balances—historical data stays in Desktop for reference.

Is Wave really free, or are there hidden costs?

Wave's core accounting and invoicing are genuinely free with no time limits or hidden fees. Costs only apply for optional payroll, payment processing, or the Pro plan for automated bank feeds.

Can I switch between alternatives if my first choice doesn't work?

Yes, but it involves repeating migration. Most businesses use a 90-day evaluation period before fully committing. Second migrations are typically easier.

Which alternative has the best mobile app?

QuickBooks Online offers the most feature-complete mobile apps, supporting invoice creation, expense entry, receipt capture, and reporting. Xero's apps are solid but less comprehensive. Wave focuses on invoicing and expense tracking.

Do these alternatives work for Mac users?

Yes, all three alternatives are cloud-based and work identically on Mac, Windows, Linux, or any device with a web browser—eliminating QuickBooks Desktop's Mac-specific limitations.

Next Steps: Making Your Decision

Step 1: Inventory your current usage. Document which Desktop features you actually use regularly. This audit takes 1-2 hours but prevents paying for unnecessary features.

Step 2: Consult your accountant. An accountant who saves $50/month on their preferred platform offsets software costs.

Step 3: Trial your top two choices. Sign up for free trials and test with actual business data. Invest 2-4 hours per platform.

Step 4: Calculate total cost. Factor in migration costs, training time, accountant fees, and add-ons for complete comparison.

Step 5: Plan your migration. Create a detailed migration plan including data transfer method, timeline, training schedule, and contingency planning. Consider professional IT consulting for complex migrations.

The transition from QuickBooks Desktop provides an opportunity to reevaluate your accounting workflow and potentially find a solution better suited to your current needs. By understanding your requirements, involving your accountant, and thoroughly testing alternatives, you can migrate successfully with minimal disruption.

Need Professional Guidance?

iFeelTech provides technology consulting for small businesses in Miami and beyond. Contact us for personalized recommendations based on your specific business requirements.

Related Resources

Accounting Software Reviews:

- Wave Accounting Review – In-depth analysis of Wave's free accounting platform

- Xero Accounting Software Review – Complete guide to Xero's features and pricing

Business Software & Tools:

- Best Business Software for Small Teams – Comprehensive software recommendations

- Harvest Review: Time Tracking & Invoicing – Time tracking for service businesses

Migration & IT Support:

- Data Backup Strategy for Small Business – Protect your financial data

- Technology Readiness Assessment – Evaluate your migration readiness

- IT Consulting Services – Professional migration assistance

Related Articles

More from Business Software

QuickBooks StackSocial "Lifetime" Deal vs QuickBooks Online: Which Makes Sense for Your Business?

Complete analysis of StackSocial's QuickBooks Desktop Pro Plus 2024 deal ($199.97) versus QuickBooks Online subscription. Compare costs, features, limitations, and find the best option for your business.

11 min read

QuickBooks vs Xero 2026: Which is Better for Small Business?

QuickBooks vs Xero comparison for 2026. Updated pricing ($115 vs $55), AI features (Intuit Assist vs JAX), and feature analysis to find the right accounting software for your business.

13 min read

Complete Business Software Stack Under $250/Month: 2026 Guide for Small Business

Build a complete business software stack for under $250/month. Professional tools for accounting, CRM, project management & more. 2026 guide with updated pricing.

23 min read